Relief Check Us: Your Definitive Guide to Understanding and Accessing Financial Assistance

Navigating the complexities of government assistance programs can be daunting. This guide provides a comprehensive, expert-backed overview of “Relief Check Us,” a term often used to describe government-issued financial aid designed to provide economic relief during crises. Whether you’re trying to understand eligibility requirements, track the status of your payment, or simply learn more about the various programs available, this resource will equip you with the knowledge and tools you need. We aim to provide clarity, eliminate confusion, and ensure you have access to the financial support you deserve. This guide is your authoritative source for all things related to accessing and understanding your “Relief Check Us” benefits.

Understanding Relief Check Us: A Comprehensive Overview

The term “Relief Check Us” broadly refers to direct payments issued by the United States government to its citizens and residents during times of economic hardship. These checks are typically intended to stimulate the economy and provide financial assistance to individuals and families facing challenges. The specific details of each program, including eligibility criteria, payment amounts, and distribution methods, can vary significantly.

Historical Context of Relief Checks

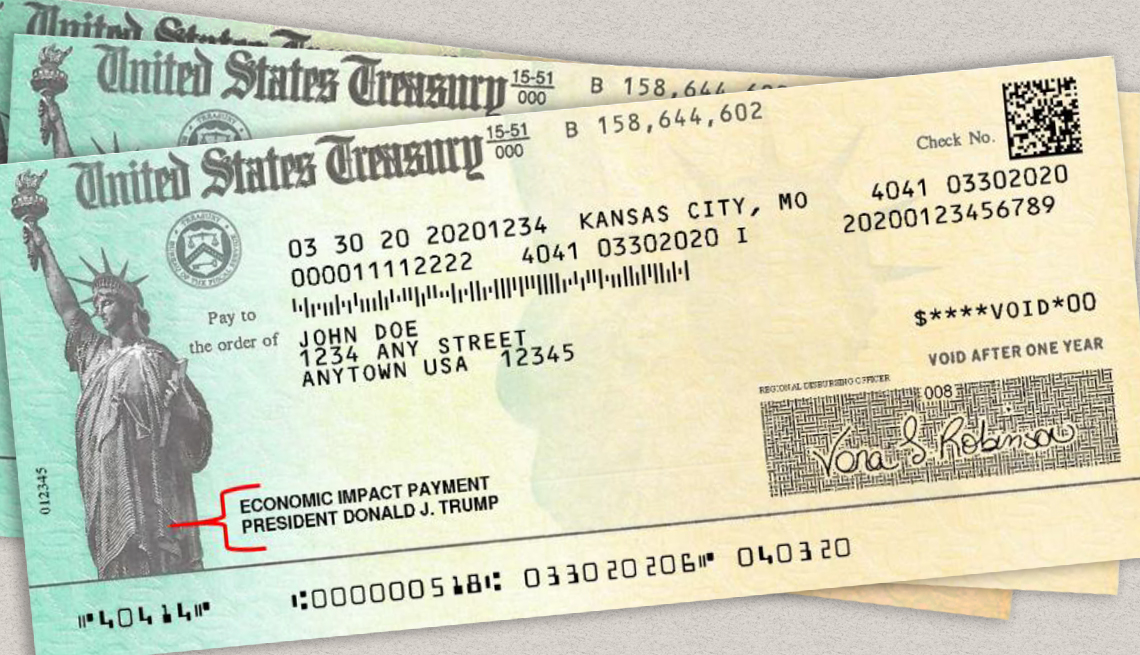

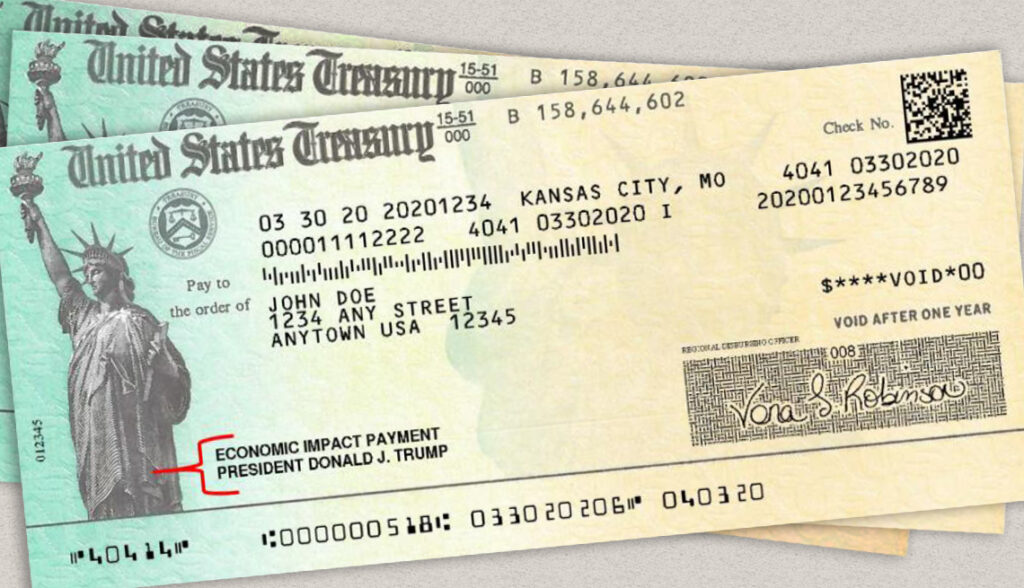

The concept of government-issued relief checks isn’t new. Throughout history, governments have implemented various forms of financial assistance to support their populations during crises. Modern relief checks, however, gained prominence during the 2008 financial crisis and have been further amplified by events such as the COVID-19 pandemic. These events underscored the critical role of direct financial assistance in stabilizing the economy and providing a safety net for vulnerable populations.

Key Principles Behind Relief Check Programs

Relief check programs are generally based on several core principles:

- Economic Stimulus: Injecting money directly into the economy to encourage spending and investment.

- Financial Assistance: Providing immediate financial relief to individuals and families struggling to meet basic needs.

- Targeted Support: Focusing assistance on those most affected by the crisis, such as low-income households and individuals who have lost their jobs.

The Evolution of Relief Check Programs

Relief check programs have evolved over time, adapting to changing economic conditions and technological advancements. Early programs often relied on paper checks, while more recent initiatives have incorporated direct deposit and debit cards to expedite payments and reduce administrative costs. The criteria for eligibility and the amount of assistance provided have also varied depending on the specific circumstances and the goals of the program.

The Economic Impact of Relief Checks

Relief checks are designed to have a significant impact on the economy by boosting consumer spending and supporting businesses. The effectiveness of these programs, however, depends on various factors, including the size of the payments, the speed of distribution, and the overall economic climate. Understanding these factors is crucial for assessing the true value of “Relief Check Us” initiatives.

Boosting Consumer Spending

One of the primary goals of relief checks is to encourage consumer spending. When people receive direct payments, they are more likely to spend that money on goods and services, which in turn stimulates economic activity. This increased spending can help businesses stay afloat and create jobs. As many economists suggest, this boost is more effective than tax cuts that favor the wealthy.

Supporting Businesses

Increased consumer spending directly benefits businesses by increasing their revenue. This can help businesses cover their expenses, retain employees, and even expand their operations. Relief checks can be particularly beneficial for small businesses, which often struggle to weather economic downturns.

Potential Drawbacks

While relief checks can provide a much-needed boost to the economy, they also have potential drawbacks. One concern is that they can contribute to inflation by increasing demand without a corresponding increase in supply. Another concern is that they may not be as effective if people save the money instead of spending it.

Eligibility Criteria for Relief Checks: Who Qualifies?

Eligibility for relief checks typically depends on factors such as income, employment status, and residency. The specific criteria can vary depending on the program, so it’s important to carefully review the requirements for each initiative. Common eligibility considerations include:

- Income Limits: Many relief check programs have income limits, meaning that individuals or households with income above a certain threshold may not be eligible.

- Employment Status: Some programs may prioritize individuals who have lost their jobs or experienced a significant reduction in income due to the crisis.

- Residency Requirements: Most programs require recipients to be U.S. citizens or legal residents.

Navigating the Application Process

Applying for relief checks can sometimes be a complex process. It’s important to gather all the necessary documentation and carefully follow the instructions provided by the government agency administering the program. Common documents that may be required include:

- Social Security Number: Your Social Security number is typically required to verify your identity.

- Proof of Income: You may need to provide documentation to verify your income, such as tax returns or pay stubs.

- Bank Account Information: If you want to receive your payment via direct deposit, you’ll need to provide your bank account information.

Tracking Your Relief Check: Staying Informed

Once you’ve applied for a relief check, it’s important to stay informed about the status of your payment. The IRS and other government agencies typically provide online tools and resources to help you track your payment. These tools allow you to check the status of your payment, update your address, and report any issues.

Using the IRS “Get My Payment” Tool

The IRS “Get My Payment” tool is a valuable resource for tracking the status of your relief check. This tool allows you to check when your payment was issued, how it was delivered (e.g., direct deposit or mail), and whether there were any issues with your payment. To use the tool, you’ll need to provide your Social Security number, date of birth, and address.

Avoiding Scams

Unfortunately, relief check programs can attract scammers who try to take advantage of people in need. It’s important to be cautious and avoid providing personal information to anyone who contacts you unsolicited. The IRS will never ask you for your bank account information or Social Security number via email or phone. If you receive a suspicious communication, report it to the IRS immediately.

Relief Check Alternatives and Supplementary Programs

While “Relief Check Us” programs provide vital support, it’s also crucial to be aware of alternative and supplementary resources available to those facing financial hardship. These may include unemployment benefits, food assistance programs, and housing assistance initiatives.

Unemployment Benefits

Unemployment benefits provide temporary financial assistance to individuals who have lost their jobs. These benefits can help cover essential expenses while you search for new employment. Eligibility requirements and benefit amounts vary by state, so it’s important to check with your local unemployment office for more information.

Food Assistance Programs

Food assistance programs, such as the Supplemental Nutrition Assistance Program (SNAP), provide financial assistance to low-income individuals and families to help them purchase groceries. These programs can help ensure that people have access to nutritious food during times of economic hardship.

Housing Assistance Initiatives

Housing assistance initiatives, such as Section 8 vouchers, provide financial assistance to low-income individuals and families to help them afford housing. These programs can help prevent homelessness and ensure that people have a safe and stable place to live.

Expert Perspectives on Relief Check Programs

Economists and policy experts have varying opinions on the effectiveness of relief check programs. Some argue that they are a valuable tool for stimulating the economy and providing financial assistance to those in need, while others express concerns about their potential drawbacks, such as inflation and increased debt. A nuanced understanding of these perspectives is crucial for evaluating the overall impact of “Relief Check Us” initiatives.

Arguments in Favor

Proponents of relief check programs argue that they provide a much-needed boost to the economy by increasing consumer spending and supporting businesses. They also argue that they are a valuable tool for providing financial assistance to individuals and families who are struggling to meet basic needs. Studies have shown that relief checks can be particularly effective in reducing poverty and food insecurity.

Concerns and Criticisms

Critics of relief check programs express concerns about their potential drawbacks, such as inflation and increased debt. They argue that these programs can lead to higher prices and a larger national debt, which can have negative consequences for the economy in the long run. Some also argue that relief checks may not be as effective if people save the money instead of spending it.

Understanding the “Get My Payment” Tool: A Deep Dive

The “Get My Payment” tool, offered by the IRS, is an essential resource for anyone expecting a “Relief Check Us” payment. It allows users to track the status of their payment, confirm their eligibility, and even update their banking information in certain situations. However, navigating this tool can sometimes be confusing. Let’s break down its features and how to use them effectively.

Accessing the Tool and Verifying Your Identity

The “Get My Payment” tool can be accessed directly through the IRS website. To use the tool, you’ll need to provide your Social Security number (or Individual Taxpayer Identification Number), date of birth, and address. The tool uses this information to verify your identity and retrieve your payment information. It’s crucial to enter this information accurately to avoid any issues.

Understanding Payment Statuses

The “Get My Payment” tool provides several different payment statuses, each indicating a different stage in the payment process. Common statuses include:

- Payment Status Available: This means that your payment has been processed and is scheduled to be sent to you. The tool will provide an estimated delivery date.

- Payment Status Not Available: This means that your payment has not yet been processed or that you are not eligible for a payment. There could be several reasons for this, such as income exceeding the eligibility threshold or an incomplete tax return.

- Need More Information: This means that the IRS needs additional information from you to process your payment. The tool will provide instructions on how to provide the necessary information.

Troubleshooting Common Issues

Sometimes, users may encounter issues while using the “Get My Payment” tool. Common issues include:

- Incorrect Information: Make sure you’re entering your information accurately. Even a minor typo can prevent the tool from retrieving your payment information.

- Payment Not Found: If you’re eligible for a payment but the tool says that your payment cannot be found, it’s possible that your payment is still being processed or that there’s an issue with your tax return.

- Technical Difficulties: The “Get My Payment” tool can sometimes experience technical difficulties due to high traffic. If you’re having trouble accessing the tool, try again later.

Real-World Impact: Stories of Relief Check Assistance

To truly understand the value of “Relief Check Us,” it’s helpful to consider real-world examples of how these payments have impacted individuals and families. While specific names and details are kept confidential, the following scenarios illustrate the types of challenges that relief checks can help address.

Scenario 1: Supporting a Family Through Job Loss

A single mother lost her job due to business closures related to the pandemic. The “Relief Check Us” payment allowed her to cover essential expenses, such as rent and groceries, while she searched for new employment. Without this assistance, she would have faced the risk of homelessness.

Scenario 2: Helping a Small Business Owner Stay Afloat

A small business owner saw a significant decline in revenue due to the pandemic. The “Relief Check Us” payment allowed him to cover his operating expenses and retain his employees. This helped him keep his business afloat during a difficult time.

Scenario 3: Providing Financial Stability for Seniors

A senior citizen on a fixed income struggled to afford essential expenses due to rising healthcare costs. The “Relief Check Us” payment provided her with the financial stability she needed to cover her expenses and maintain her quality of life.

Q&A: Your Burning Questions About “Relief Check Us” Answered

-

Q: How do I know if I’m eligible for a “Relief Check Us” payment?

A: Eligibility depends on the specific program. Generally, factors such as income, residency, and filing status are considered. Check the official IRS website or relevant government agency for the specific requirements of each program.

-

Q: What if I didn’t receive a payment I believe I was entitled to?

A: Use the IRS “Get My Payment” tool to check the status of your payment. If the tool indicates that a payment was issued but you didn’t receive it, contact the IRS for assistance.

-

Q: Can I still claim a previous “Relief Check Us” payment if I missed the deadline?

A: In some cases, you may be able to claim a previous payment as a tax credit when you file your tax return. Check with the IRS or a tax professional for guidance.

-

Q: How are “Relief Check Us” payments taxed?

A: Generally, these payments are not considered taxable income. However, it’s always best to consult with a tax professional to ensure you understand the specific tax implications.

-

Q: What should I do if I receive a suspicious email or phone call claiming to be from the IRS regarding a “Relief Check Us” payment?

A: Do not provide any personal information. The IRS will never ask for your bank account information or Social Security number via email or phone. Report the suspicious communication to the IRS immediately.

-

Q: Where can I find information about future “Relief Check Us” programs?

A: Stay informed by following official government websites, news outlets, and reputable financial publications. Be wary of unofficial sources and social media rumors.

-

Q: I moved since I last filed my taxes. How does this affect my relief check?

A: You should update your address with the IRS as soon as possible to ensure your payment is sent to the correct location. You can do this online or by submitting a change of address form.

-

Q: Are non-citizens eligible for relief checks?

A: Eligibility for non-citizens depends on the specific program and their immigration status. Some programs may require recipients to be U.S. citizens or legal residents.

-

Q: What if I owe back taxes? Will that affect my eligibility for a relief check?

A: In some cases, the IRS may offset your relief check to pay for back taxes or other debts owed to the government. However, this depends on the specific program and your individual circumstances.

-

Q: Can I donate my relief check to charity?

A: Yes, you are free to donate your relief check to a qualified charity if you choose. This can be a meaningful way to support those in need.

Conclusion: Navigating Your Path to Financial Relief

Understanding the intricacies of “Relief Check Us” programs is crucial for accessing the financial assistance you deserve. By staying informed, carefully reviewing eligibility requirements, and avoiding scams, you can navigate the process with confidence. This guide has provided you with a comprehensive overview of these programs, empowering you to make informed decisions and secure the support you need. We encourage you to share this resource with others who may benefit from this information. If you have further questions, consult with a qualified financial advisor or tax professional.