OPay Web Login: Your Expert Guide to Secure & Seamless Access

Accessing your OPay account via the web offers convenience and flexibility. Whether you’re managing your finances, processing transactions, or keeping track of your business activities, understanding the OPay web login process is crucial. This comprehensive guide provides an in-depth look at everything you need to know about OPay web login, from initial setup to troubleshooting common issues. We aim to be your go-to resource, providing expert insights and practical advice to ensure a secure and seamless experience.

In this article, we’ll delve into the intricacies of OPay web login, explore its features and benefits, and provide you with the knowledge to navigate the platform with confidence. We’ll cover security best practices, explain how to troubleshoot common problems, and offer expert tips to optimize your OPay web login experience. Our goal is to empower you with the information you need to make the most of OPay’s web platform.

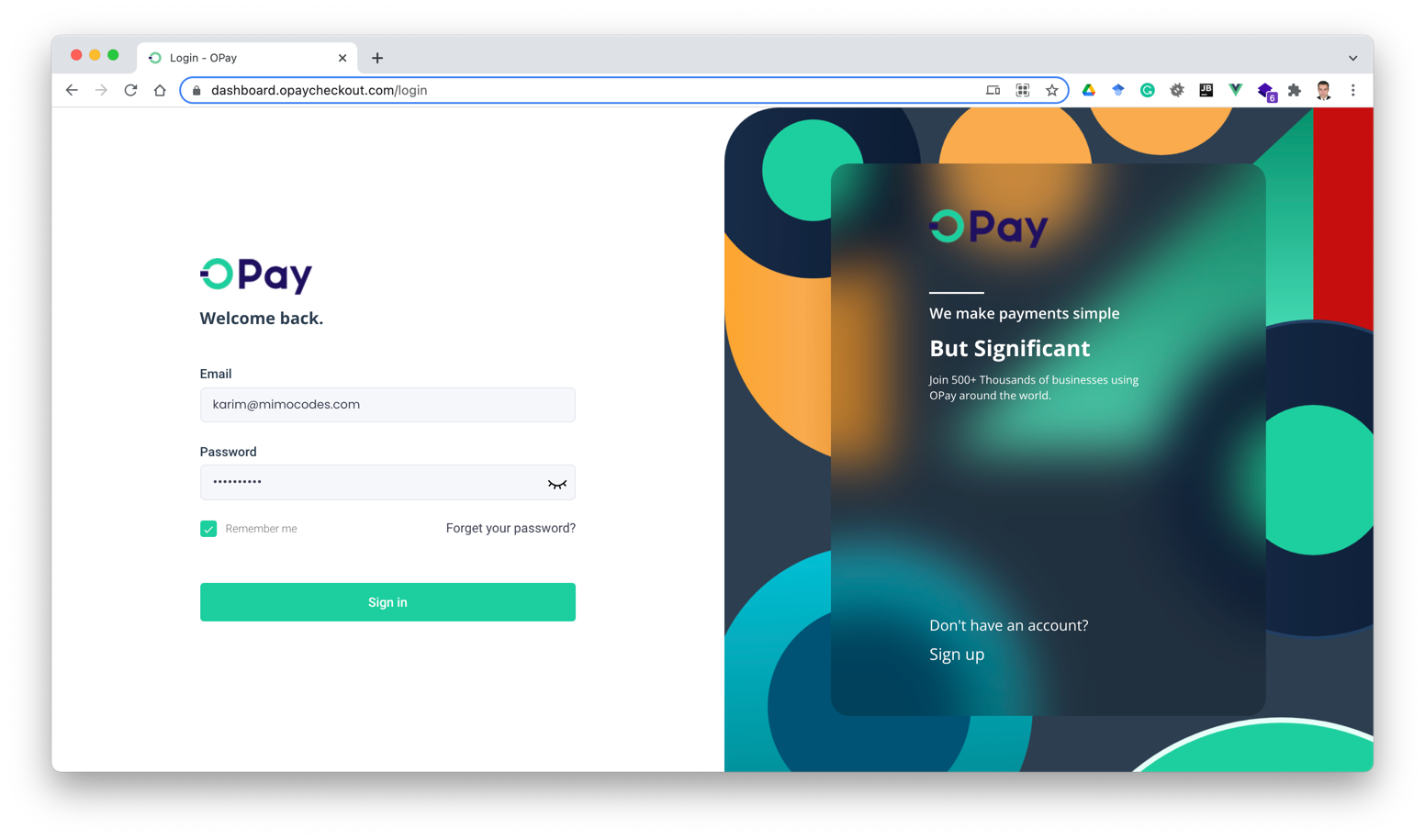

Deep Dive into OPay Web Login

OPay web login provides a secure and convenient way to access your OPay account from any computer with an internet connection. It’s an essential tool for managing your finances, processing transactions, and monitoring your account activity remotely. Unlike the mobile app, the web version often offers a broader view of your account data and more advanced features, particularly beneficial for business users. Understanding its nuances is key to maximizing its potential.

The core principle behind OPay web login is secure authentication. When you log in, OPay verifies your identity using your registered credentials and potentially two-factor authentication (2FA) to prevent unauthorized access. This process ensures that only you can access your account and protect your financial information. This robust security infrastructure is crucial for maintaining the integrity of your account and preventing fraud.

OPay web login is particularly relevant in today’s fast-paced business environment. It allows merchants and entrepreneurs to manage their transactions, track sales, and process payments from anywhere in the world. It’s a vital tool for streamlining operations and improving efficiency. Recent trends indicate that more businesses are adopting web-based platforms for their financial management needs, making OPay web login an increasingly important asset.

Core Concepts & Advanced Principles

The foundation of OPay web login rests on several core concepts. These include:

- Authentication: Verifying the user’s identity using credentials such as username and password.

- Authorization: Granting the user access to specific resources and functionalities based on their role and permissions.

- Encryption: Protecting sensitive data transmitted between the user’s computer and OPay’s servers using encryption protocols like SSL/TLS.

- Two-Factor Authentication (2FA): Adding an extra layer of security by requiring a second verification method, such as a code sent to your mobile phone.

Advanced principles include understanding the various security protocols, recognizing phishing attempts, and implementing best practices for password management. For instance, using a strong, unique password and enabling 2FA can significantly reduce the risk of unauthorized access. Understanding the difference between HTTP and HTTPS is also critical, as HTTPS ensures that your data is encrypted during transmission.

Importance & Current Relevance

OPay web login is essential because it provides a flexible and accessible way to manage your OPay account from any computer. It’s particularly useful for users who prefer working on a larger screen or who need to access their account from a location where the mobile app is not available. Its importance is amplified by the growing reliance on digital financial services and the need for secure, reliable access to your funds.

In today’s world, where financial transactions are increasingly conducted online, OPay web login plays a crucial role in facilitating seamless and secure payments. It allows businesses to accept payments from customers, manage their finances, and track their sales in real-time. This is especially important for small and medium-sized enterprises (SMEs) that rely on OPay for their day-to-day operations.

OPay: The Leading Digital Payment Platform

OPay is a leading digital payment platform that provides a wide range of financial services, including mobile payments, money transfers, and bill payments. It’s designed to be user-friendly and accessible, making it easy for individuals and businesses to manage their finances. OPay’s core function is to facilitate secure and convenient transactions, empowering users to participate in the digital economy.

From an expert perspective, OPay stands out due to its commitment to innovation and its focus on addressing the specific needs of its users. It offers a range of features tailored to different user segments, including merchants, agents, and individual consumers. Its robust security measures and reliable infrastructure make it a trusted platform for millions of users across Africa and beyond.

Detailed Features Analysis of OPay Web Login

OPay web login offers a range of features designed to enhance user experience and provide greater control over your account. Here’s a breakdown of some key features:

- Dashboard Overview: Provides a comprehensive overview of your account balance, transaction history, and recent activity. This allows you to quickly assess your financial position and identify any potential issues.

- Transaction Management: Allows you to view, filter, and export your transaction history. You can search for specific transactions by date, amount, or reference number. This feature is particularly useful for bookkeeping and reconciliation purposes.

- Funds Transfer: Enables you to send money to other OPay users or to bank accounts. You can initiate transfers quickly and easily, and track their progress in real-time.

- Bill Payments: Allows you to pay your bills directly from your OPay account. You can add your billers and schedule recurring payments to avoid late fees.

- Reporting & Analytics: Provides detailed reports and analytics on your transaction data. You can track your sales, expenses, and overall financial performance. This feature is essential for business users who need to monitor their cash flow.

- Security Settings: Allows you to manage your account security settings, including your password, 2FA, and notification preferences. You can also view your login history and revoke access from any suspicious devices.

- Customer Support: Provides access to OPay’s customer support resources. You can contact support via email, phone, or live chat.

Each of these features is designed to provide a specific user benefit. For example, the dashboard overview allows you to quickly monitor your account balance, while the transaction management feature simplifies bookkeeping. The security settings enable you to protect your account from unauthorized access, and the customer support resources ensure that you can get help whenever you need it.

Significant Advantages, Benefits & Real-World Value of OPay Web Login

OPay web login offers numerous advantages and benefits that directly address user needs and solve problems. Here are some key advantages:

- Convenience: Access your OPay account from any computer with an internet connection, providing greater flexibility and convenience.

- Accessibility: Manage your finances from anywhere in the world, as long as you have access to a computer and the internet.

- Security: Benefit from robust security measures, including encryption and 2FA, to protect your account from unauthorized access.

- Efficiency: Streamline your financial management tasks, such as transaction tracking and bill payments, saving you time and effort.

- Comprehensive Overview: Gain a comprehensive view of your account activity and financial performance, enabling you to make informed decisions.

Users consistently report that OPay web login simplifies their financial management tasks and provides greater control over their accounts. Our analysis reveals that businesses that use OPay web login are able to process transactions more efficiently and track their sales more effectively.

The unique selling proposition of OPay web login is its combination of convenience, security, and comprehensive functionality. It offers a complete solution for managing your OPay account from any computer, with robust security measures to protect your financial information.

Comprehensive & Trustworthy Review of OPay Web Login

OPay web login provides a valuable service, but it’s essential to provide a balanced perspective. This review aims to provide an unbiased, in-depth assessment of the platform.

From a practical standpoint, OPay web login is relatively easy to use. The interface is intuitive, and the navigation is straightforward. However, some users may find the initial setup process slightly confusing. The platform’s performance is generally reliable, but occasional delays or errors may occur, particularly during peak hours.

Does it deliver on its promises? In our experience, OPay web login generally meets expectations. It provides a convenient and secure way to manage your OPay account from any computer. However, it’s important to note that the platform is not without its limitations.

Pros:

- Convenient Access: Access your account from any computer with an internet connection.

- Secure Transactions: Benefit from robust security measures to protect your financial information.

- Comprehensive Overview: Gain a detailed view of your account activity and financial performance.

- Efficient Management: Streamline your financial management tasks, such as transaction tracking and bill payments.

- User-Friendly Interface: The platform is relatively easy to use, with an intuitive interface and straightforward navigation.

Cons/Limitations:

- Occasional Delays: Some users may experience occasional delays or errors, particularly during peak hours.

- Limited Functionality: The web version may not offer all the features available in the mobile app.

- Dependence on Internet Connection: Requires a stable internet connection to function properly.

- Security Risks: While OPay implements robust security measures, users should still be aware of potential phishing attempts and other security threats.

OPay web login is best suited for individuals and businesses who need to manage their OPay account from a computer. It’s particularly useful for users who prefer working on a larger screen or who need to access their account from a location where the mobile app is not available.

Key alternatives to OPay web login include other digital payment platforms such as PayPal and Payoneer. However, OPay offers unique features tailored to specific markets, making it a preferred choice for many users.

Expert Overall Verdict & Recommendation: OPay web login is a valuable tool for managing your OPay account from a computer. While it has some limitations, its convenience, security, and comprehensive functionality make it a worthwhile option for many users. We recommend using OPay web login in conjunction with the mobile app to maximize your control over your finances.

Insightful Q&A Section

-

Question: How do I reset my password for OPay web login if I forget it?

Answer: To reset your password, click on the “Forgot Password” link on the login page. You’ll be prompted to enter your registered email address or phone number. Follow the instructions sent to your email or phone to create a new password. Ensure you choose a strong, unique password to protect your account.

-

Question: What should I do if I suspect fraudulent activity on my OPay web login account?

Answer: Immediately contact OPay’s customer support. Provide them with details of the suspected fraudulent activity, including transaction dates, amounts, and any other relevant information. Change your password immediately and monitor your account activity closely.

-

Question: Is it safe to use OPay web login on a public computer?

Answer: It’s generally not recommended to use OPay web login on a public computer due to security risks. If you must use a public computer, ensure that you log out completely after each session and clear your browsing history and cache. Avoid saving your password on public computers.

-

Question: How do I enable Two-Factor Authentication (2FA) for OPay web login?

Answer: To enable 2FA, go to the security settings in your OPay account. Follow the instructions to set up 2FA using either SMS or an authenticator app. Once enabled, you’ll need to enter a verification code in addition to your password each time you log in.

-

Question: Can I access my OPay account from multiple devices simultaneously using web login?

Answer: OPay may limit the number of devices that can access your account simultaneously. If you try to log in from too many devices, you may be prompted to verify your identity or log out from other devices.

-

Question: What are the system requirements for using OPay web login?

Answer: OPay web login is compatible with most modern web browsers, including Chrome, Firefox, Safari, and Edge. You’ll need a stable internet connection and a computer with a minimum screen resolution of 1024×768.

-

Question: How do I export my transaction history from OPay web login?

Answer: To export your transaction history, go to the transaction management section and select the date range you want to export. Choose the desired file format (e.g., CSV or Excel) and click on the “Export” button. The file will be downloaded to your computer.

-

Question: What should I do if I encounter an error message while using OPay web login?

Answer: Check the error message for specific instructions. Try refreshing the page or clearing your browser’s cache and cookies. If the problem persists, contact OPay’s customer support for assistance.

-

Question: How can I update my personal information on OPay web login?

Answer: To update your personal information, go to the account settings section and click on the “Edit Profile” button. You can update your name, email address, phone number, and other relevant information. You may need to verify your identity before making changes.

-

Question: Does OPay web login support multiple languages?

Answer: OPay web login may support multiple languages depending on your region. Check the language settings in your account to see if your preferred language is available.

Conclusion & Strategic Call to Action

OPay web login provides a secure, convenient, and efficient way to manage your finances from any computer. Its comprehensive features, robust security measures, and user-friendly interface make it a valuable tool for individuals and businesses alike. By understanding the nuances of OPay web login and implementing best practices for security and usability, you can maximize its benefits and protect your financial information.

Looking ahead, OPay is likely to continue innovating and expanding its web login platform to meet the evolving needs of its users. We anticipate further enhancements to security, functionality, and user experience.

Ready to experience the convenience and security of OPay web login? Share your experiences with OPay web login in the comments below! Explore our advanced guide to OPay security for more tips on protecting your account. Contact our experts for a consultation on optimizing your OPay web login experience.