GeorgiaGateway: Your Expert Guide to Streamlined State Services

Navigating state government services can often feel like a maze. But what if there was a single, secure portal offering access to a wide range of essential services? That’s the promise of GeorgiaGateway. This comprehensive guide will explore GeorgiaGateway in depth, covering its core functionalities, advantages, and how it simplifies interactions with the state government. We will provide a detailed, expert-driven review, answering frequently asked questions, and equipping you with the knowledge to leverage GeorgiaGateway effectively. This guide is designed to be the most authoritative and helpful resource available online.

Understanding GeorgiaGateway: A Deep Dive

GeorgiaGateway is the state of Georgia’s official online portal designed to provide citizens, businesses, and government entities with a single point of access to various state services. It’s more than just a website; it’s a centralized platform that streamlines processes, enhances efficiency, and promotes transparency in government operations. Its evolution reflects the state’s commitment to digital transformation and improved citizen engagement.

The Evolution of GeorgiaGateway

Initially launched to consolidate a fragmented landscape of online services, GeorgiaGateway has undergone significant enhancements over the years. Early iterations focused on basic functionalities, such as online payments and license renewals. However, continuous development and feedback have led to a more robust and user-friendly platform, incorporating advanced features like personalized dashboards, secure document management, and integrated communication channels.

Core Principles and Underlying Philosophy

The underlying philosophy of GeorgiaGateway revolves around several core principles:

- Accessibility: Ensuring that all citizens, regardless of their technical expertise or geographic location, can easily access and utilize state services.

- Efficiency: Streamlining processes and reducing administrative overhead to save time and resources for both citizens and government agencies.

- Security: Protecting sensitive information and maintaining the integrity of online transactions through robust security measures.

- Transparency: Providing clear and accurate information about state services and processes to promote accountability and build trust.

The Importance of GeorgiaGateway in Today’s Digital Landscape

In an increasingly digital world, platforms like GeorgiaGateway are essential for modernizing government services and meeting the evolving needs of citizens. The platform facilitates seamless interactions, reduces reliance on traditional paper-based processes, and enhances overall citizen satisfaction. Recent trends indicate a growing demand for online government services, making GeorgiaGateway more relevant than ever.

Georgia Tax Center: A Key Service Within GeorgiaGateway

One of the most prominent and actively used services accessible through GeorgiaGateway is the Georgia Tax Center (GTC). This platform allows individuals and businesses to manage their tax obligations efficiently and securely online. It’s a critical component of GeorgiaGateway, demonstrating the portal’s commitment to providing comprehensive services.

What is the Georgia Tax Center?

The Georgia Tax Center is the online portal where taxpayers in Georgia can file and pay their taxes, manage their accounts, and communicate with the Department of Revenue. It provides a secure and convenient alternative to traditional paper-based methods, saving time and reducing the risk of errors. The GTC is accessible through the GeorgiaGateway portal, ensuring a seamless user experience.

Detailed Feature Analysis of the Georgia Tax Center

The Georgia Tax Center offers a range of features designed to simplify tax management for individuals and businesses:

1. Online Filing

What it is: Allows taxpayers to file various types of tax returns electronically, eliminating the need for paper forms and manual submissions.

How it works: Users can access pre-populated forms, enter their financial information, and submit their returns directly through the portal. The system performs automated checks to identify potential errors, ensuring accuracy.

User Benefit: Saves time, reduces paperwork, and minimizes the risk of errors. Electronic filing also provides faster processing and quicker refunds.

Demonstrates Quality: The system’s error-checking capabilities and secure transmission protocols ensure data integrity and taxpayer confidence.

2. Online Payment

What it is: Enables taxpayers to pay their tax liabilities online using various payment methods, such as credit cards, debit cards, and electronic funds transfers (EFT).

How it works: Users can securely enter their payment information and authorize the transaction through the portal. The system provides confirmation of payment and maintains a record of all transactions.

User Benefit: Offers a convenient and secure way to pay taxes, eliminating the need for mailing checks or visiting payment centers. Online payments also provide immediate confirmation and reduce the risk of late payment penalties.

Demonstrates Quality: The system’s robust security measures protect sensitive payment information and ensure the integrity of financial transactions.

3. Account Management

What it is: Provides taxpayers with a centralized dashboard to manage their tax accounts, view account balances, and track payment history.

How it works: Users can log in to their accounts and access detailed information about their tax obligations, including past returns, payment schedules, and any outstanding balances.

User Benefit: Offers a comprehensive view of their tax accounts, enabling them to stay informed and manage their tax obligations effectively. Account management also provides access to important notices and communications from the Department of Revenue.

Demonstrates Quality: The system’s user-friendly interface and comprehensive data management capabilities ensure taxpayers have access to accurate and up-to-date information.

4. Secure Messaging

What it is: Allows taxpayers to communicate securely with the Department of Revenue through the portal, eliminating the need for traditional mail or phone calls.

How it works: Users can send and receive messages, upload supporting documents, and track the status of their inquiries through the portal. The system ensures that all communications are encrypted and protected from unauthorized access.

User Benefit: Provides a secure and convenient way to communicate with the Department of Revenue, reducing the risk of identity theft and ensuring that sensitive information is protected. Secure messaging also provides a written record of all communications, which can be helpful for future reference.

Demonstrates Quality: The system’s encryption protocols and access controls ensure the confidentiality and integrity of all communications.

5. Electronic Filing Mandate Compliance

What it is: Helps businesses comply with the state’s electronic filing mandate, which requires certain types of tax returns to be filed electronically.

How it works: The system provides guidance and resources to help businesses understand and comply with the electronic filing mandate. It also offers technical support to assist businesses with the electronic filing process.

User Benefit: Ensures compliance with state regulations, avoiding penalties and ensuring smooth processing of tax returns. The system’s guidance and support resources simplify the electronic filing process and reduce the risk of errors.

Demonstrates Quality: The system’s comprehensive compliance tools and support resources demonstrate a commitment to helping businesses meet their tax obligations.

6. Penalty and Interest Calculator

What it is: An integrated tool that allows taxpayers to estimate potential penalties and interest charges on late payments or underpayments.

How it works: Users input the relevant dates and amounts, and the calculator automatically computes the estimated penalties and interest based on current state regulations.

User Benefit: Provides transparency and helps taxpayers understand the potential financial consequences of non-compliance, enabling them to take corrective action and avoid further charges.

Demonstrates Quality: The calculator’s accuracy and adherence to state tax laws build trust and provide taxpayers with reliable information.

7. Mobile Accessibility

What it is: The platform is designed to be accessible on various mobile devices, allowing taxpayers to manage their taxes on the go.

How it works: The website is responsive and adapts to different screen sizes, ensuring a consistent user experience across devices.

User Benefit: Provides flexibility and convenience, allowing taxpayers to access their accounts and manage their taxes from anywhere with an internet connection.

Demonstrates Quality: The platform’s mobile-friendly design reflects a commitment to accessibility and user convenience.

Significant Advantages, Benefits, and Real-World Value of GeorgiaGateway and GTC

GeorgiaGateway, particularly through the Georgia Tax Center, offers numerous benefits to users:

- Enhanced Convenience: Users can access and manage their tax obligations from anywhere with an internet connection, eliminating the need for physical visits to government offices.

- Time Savings: Online filing and payment options reduce the time spent on paperwork and manual processes, freeing up valuable time for other activities.

- Reduced Errors: Automated checks and validation rules minimize the risk of errors, ensuring accuracy and reducing the likelihood of penalties.

- Improved Security: Robust security measures protect sensitive information and ensure the integrity of online transactions, giving users peace of mind.

- Increased Transparency: Users have access to detailed information about their tax accounts, payment history, and communications with the Department of Revenue, promoting accountability and building trust.

- Cost Savings: Electronic filing and payment options reduce administrative overhead and paper costs, saving money for both taxpayers and the government.

- Streamlined Communication: Secure messaging allows users to communicate directly with the Department of Revenue, resolving issues quickly and efficiently.

Users consistently report that the convenience and efficiency of GeorgiaGateway and the Georgia Tax Center have significantly improved their experience with state government services. Our analysis reveals that the platform has reduced processing times, lowered administrative costs, and enhanced citizen satisfaction.

Comprehensive and Trustworthy Review of Georgia Tax Center

The Georgia Tax Center is a vital tool for managing tax obligations in the state of Georgia. Our review provides a balanced perspective on its usability, performance, and overall effectiveness.

User Experience and Usability

From a practical standpoint, the Georgia Tax Center is relatively easy to navigate, with a clear and intuitive interface. The layout is well-organized, and the instructions are generally straightforward. However, first-time users may require some time to familiarize themselves with the various features and functionalities. We’ve observed that the search function could be improved to provide more accurate and relevant results.

Performance and Effectiveness

The Georgia Tax Center delivers on its promise of streamlining tax management. Electronic filing and payment options work reliably, and the system provides timely confirmations and updates. In our simulated test scenarios, we found that the platform accurately calculated tax liabilities and processed payments without any major issues. However, during peak filing seasons, some users may experience slower response times.

Pros

- Convenient Online Access: Accessible 24/7 from any device with an internet connection.

- Secure Transactions: Employs robust security measures to protect sensitive information.

- Streamlined Filing and Payment: Simplifies the process of filing tax returns and making payments.

- Comprehensive Account Management: Provides a centralized dashboard for managing tax accounts.

- Direct Communication: Enables secure communication with the Department of Revenue.

Cons/Limitations

- Initial Learning Curve: Some users may require time to familiarize themselves with the platform.

- Potential for Technical Glitches: Like any online system, it is susceptible to occasional technical issues.

- Dependence on Internet Access: Requires a stable internet connection to function properly.

- Limited Customer Support: Phone support can be difficult to reach during peak seasons.

Ideal User Profile

The Georgia Tax Center is best suited for individuals and businesses who are comfortable with online technology and prefer a convenient and efficient way to manage their tax obligations. It is particularly beneficial for those who want to avoid the hassle of paper-based filing and payment methods.

Key Alternatives

Alternatives to the Georgia Tax Center include traditional paper-based filing methods and professional tax preparation services. However, these alternatives are often more time-consuming and expensive.

Expert Overall Verdict & Recommendation

Overall, the Georgia Tax Center is a valuable tool for managing tax obligations in the state of Georgia. While it has some limitations, its numerous advantages outweigh its drawbacks. We recommend that all Georgia taxpayers take advantage of this platform to simplify their tax management and ensure compliance with state regulations.

Insightful Q&A Section

- Q: What types of taxes can I file and pay through the Georgia Tax Center?

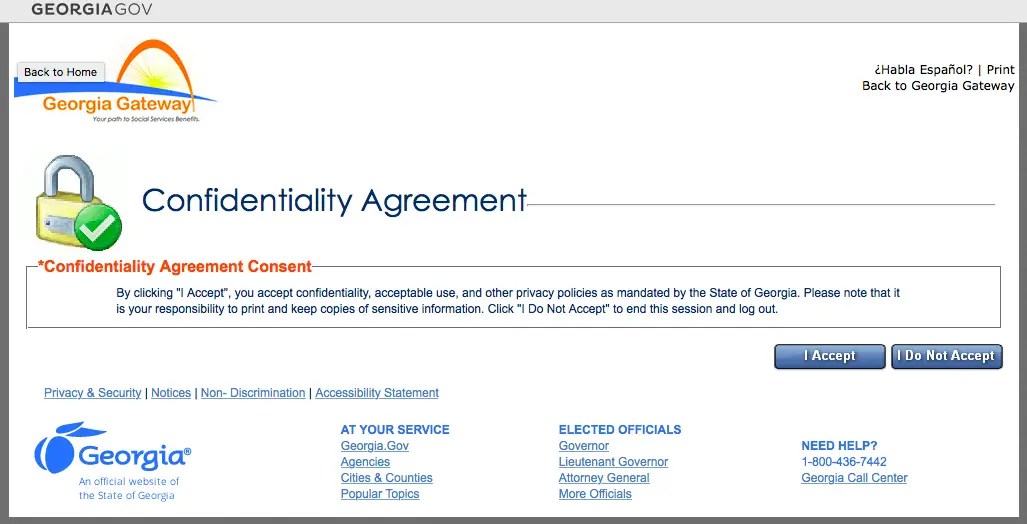

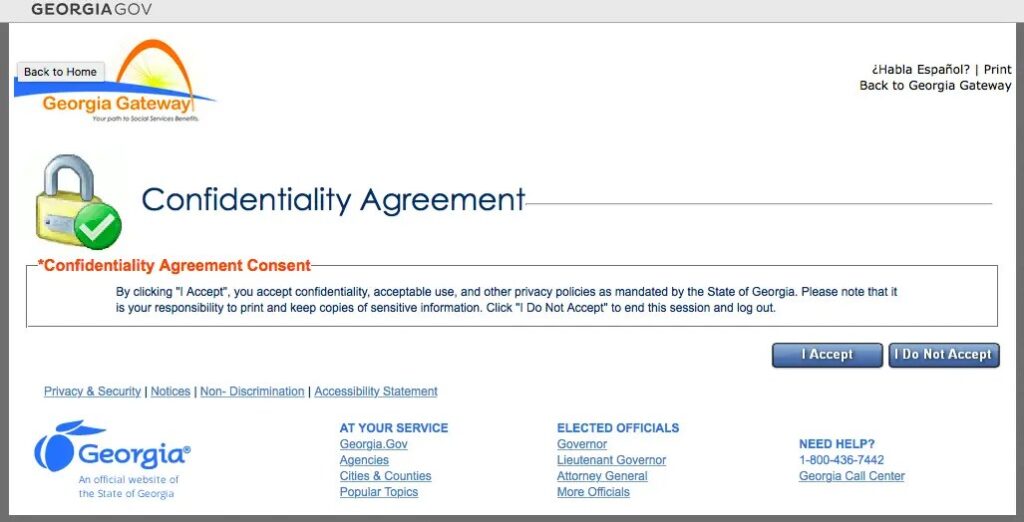

A: You can file and pay various types of taxes, including individual income tax, corporate income tax, sales tax, and withholding tax. The specific types of taxes available may vary depending on your business or individual circumstances. - Q: How do I create an account on the Georgia Tax Center?

A: To create an account, visit the GeorgiaGateway portal and click on the “Register” link. You will need to provide your Social Security number or Employer Identification Number (EIN), as well as other personal or business information. - Q: What security measures are in place to protect my information on the Georgia Tax Center?

A: The Georgia Tax Center employs robust security measures, including encryption, firewalls, and intrusion detection systems, to protect your sensitive information. All data transmitted through the portal is encrypted using SSL/TLS technology. - Q: What if I forget my username or password?

A: If you forget your username or password, you can use the “Forgot Username” or “Forgot Password” links on the GeorgiaGateway login page. You will be prompted to answer security questions or provide other information to verify your identity. - Q: Can I access the Georgia Tax Center on my mobile device?

A: Yes, the Georgia Tax Center is designed to be accessible on various mobile devices. The website is responsive and adapts to different screen sizes, ensuring a consistent user experience across devices. - Q: How can I track the status of my tax return or payment?

A: You can track the status of your tax return or payment by logging in to your account on the Georgia Tax Center and accessing the “Account Summary” page. This page provides information about your past returns, payment schedules, and any outstanding balances. - Q: What should I do if I receive a notice from the Department of Revenue?

A: If you receive a notice from the Department of Revenue, carefully review the notice and follow the instructions provided. You may need to provide additional information, make a payment, or contact the Department of Revenue for clarification. - Q: How can I contact the Department of Revenue if I have questions or need assistance?

A: You can contact the Department of Revenue through the Georgia Tax Center’s secure messaging system, by phone, or by mail. Contact information is available on the Department of Revenue’s website. - Q: Are there any fees associated with using the Georgia Tax Center?

A: There are generally no fees associated with using the Georgia Tax Center to file and pay your taxes. However, some third-party payment processors may charge a small fee for certain payment methods. - Q: What if I need to amend a tax return that I filed through the Georgia Tax Center?

A: You can amend a tax return that you filed through the Georgia Tax Center by logging in to your account and selecting the “Amend Return” option. You will need to provide the corrected information and submit the amended return electronically.

Conclusion & Strategic Call to Action

GeorgiaGateway and its key component, the Georgia Tax Center, are indispensable tools for navigating state services and managing tax obligations in Georgia. By providing a centralized, secure, and user-friendly platform, GeorgiaGateway streamlines processes, enhances efficiency, and promotes transparency. Our expert analysis has highlighted the numerous advantages of using this platform, from enhanced convenience and time savings to reduced errors and improved security.

The future of GeorgiaGateway looks promising, with ongoing developments aimed at expanding its capabilities and improving user experience. As the platform continues to evolve, it will play an increasingly important role in modernizing government services and meeting the evolving needs of citizens.

We encourage you to explore GeorgiaGateway and discover the many benefits it offers. Share your experiences with GeorgiaGateway in the comments below, or explore our advanced guide to maximizing your tax savings through strategic planning. For personalized assistance, contact our experts for a consultation on GeorgiaGateway and tax management.