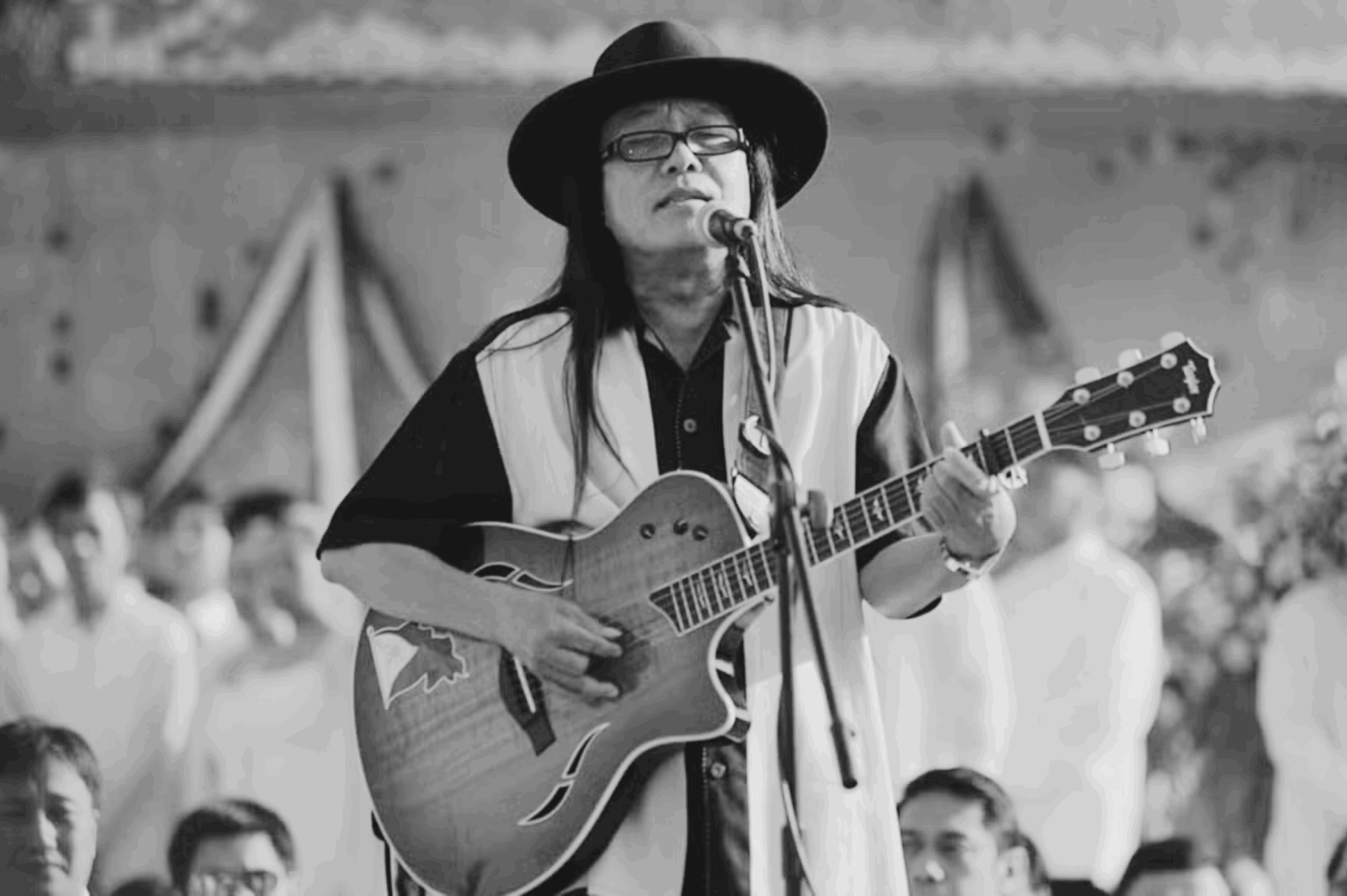

Freddie Aguilar’s Last Will and Testament: Unraveling the Legacy

Navigating the complexities surrounding the estate of a beloved artist like Freddie Aguilar requires a deep understanding of legal frameworks and personal legacies. When fans and followers search for “freddie aguilar’s last will and testament,” they are often seeking clarity on how his assets were distributed, the legal battles that might have ensued, and the overall impact on his family and artistic heritage. This comprehensive guide delves into the intricacies of estate planning, providing insights into the potential contents and implications of Freddie Aguilar’s last will and testament, even without access to the actual document. We aim to provide a thorough understanding of the legal principles involved, offering value far beyond simple speculation. Our goal is to arm you with knowledge about estate planning in the Philippines, using Freddie Aguilar’s situation as a relevant and engaging example.

Understanding Last Wills and Testaments in the Philippines

A last will and testament is a legal document that outlines a person’s wishes regarding the distribution of their assets after death. In the Philippines, the Civil Code governs the creation, execution, and validity of wills. It is a crucial part of estate planning, ensuring that the testator’s (the person making the will) desires are honored and that their loved ones are provided for.

Key Components of a Philippine Will

* **Testamentary Capacity:** The testator must be of sound mind and at least 18 years old.

* **Formal Requirements:** The will must be in writing, signed by the testator, and attested to by at least three credible witnesses (for notarial wills). Holographic wills, entirely written, dated, and signed by the testator, require no witnesses.

* **Legitime:** Philippine law protects certain compulsory heirs (e.g., spouse, children, parents) by guaranteeing them a share of the estate called the legitime. The testator cannot completely disinherit these heirs without legal cause.

* **Free Portion:** After satisfying the legitime, the testator can freely dispose of the remaining portion of their estate (the free portion) to anyone they choose.

Types of Wills Recognized in the Philippines

* **Notarial Will:** The most common type, prepared and signed in the presence of a notary public and three witnesses.

* **Holographic Will:** Entirely handwritten, dated, and signed by the testator. This type is simpler but requires strict adherence to form.

* **Probate:** The legal process of proving the validity of a will in court. Probate is necessary to transfer ownership of assets from the deceased to their heirs.

The Legal Landscape Surrounding Freddie Aguilar’s Estate

While the specific details of Freddie Aguilar’s last will and testament are not publicly available, we can explore the general legal principles that would apply to his estate in the Philippines. Given his status as a prominent artist, his estate likely included various assets, such as real property, royalties, intellectual property rights, and personal belongings.

Potential Assets and Their Distribution

* **Real Property:** Any land or buildings owned by Freddie Aguilar would be subject to distribution according to his will or the laws of intestacy if he died without a valid will.

* **Royalties:** As a musician, Freddie Aguilar likely earned royalties from his songs. These royalties would form part of his estate and be distributed to his heirs.

* **Intellectual Property Rights:** Ownership of his songs and other creative works would also pass to his heirs, allowing them to continue earning income from his artistic legacy.

* **Personal Belongings:** Items such as musical instruments, memorabilia, and personal effects would also be distributed according to his will or the laws of intestacy.

Intestacy vs. Testate Succession

If Freddie Aguilar had a valid will (testate succession), his assets would be distributed according to its terms, subject to the legal requirements regarding legitime. However, if he died without a will (intestate succession), his estate would be distributed according to the order of succession outlined in the Civil Code. This order typically favors the surviving spouse and children.

Potential Legal Challenges

Even with a valid will, legal challenges can arise. Heirs may contest the will based on arguments such as: lack of testamentary capacity, undue influence, or improper execution. Such challenges can lead to lengthy and costly court battles, delaying the distribution of the estate.

Estate Planning: A Crucial Step for Everyone

Freddie Aguilar’s situation highlights the importance of estate planning for everyone, regardless of their wealth or status. A well-drafted will can provide peace of mind, ensure that your wishes are honored, and prevent potential conflicts among your loved ones.

Benefits of Estate Planning

* **Control Over Asset Distribution:** You decide who receives your assets and in what proportion.

* **Protection for Loved Ones:** You can provide for your spouse, children, and other dependents.

* **Minimizing Estate Taxes:** Proper planning can help reduce the estate taxes payable upon your death.

* **Avoiding Probate Delays:** A clear and valid will can streamline the probate process.

* **Designating Guardians for Minor Children:** You can name guardians to care for your minor children in the event of your death.

Steps in Estate Planning

1. **Inventory Your Assets:** Make a list of all your assets, including real property, bank accounts, investments, and personal belongings.

2. **Determine Your Beneficiaries:** Decide who you want to receive your assets.

3. **Consult with an Attorney:** Seek legal advice from an experienced estate planning attorney who can help you draft a will that meets your specific needs.

4. **Execute Your Will:** Sign your will in the presence of the required witnesses and a notary public.

5. **Review and Update Your Will:** Periodically review your will to ensure it still reflects your wishes and to account for any changes in your circumstances.

Featured Product: Philippine Legal Will Template by LegalEase PH

In the context of discussing Freddie Aguilar’s last will and testament, understanding the tools and resources available for creating one is crucial. LegalEase PH offers a robust and user-friendly Philippine Legal Will Template designed to simplify the estate planning process. This template is crafted by experienced lawyers to comply with Philippine law, ensuring that your wishes are legally sound and effectively documented.

This product stands out because it is not just a generic form; it is specifically tailored to the Philippine legal system, addressing the unique requirements for valid wills in the country. It is designed to be accessible and understandable, even for those without legal expertise, making it an ideal starting point for anyone looking to create their own will.

Detailed Features Analysis of the Philippine Legal Will Template by LegalEase PH

This template offers several key features that make it a valuable tool for estate planning:

* **Compliant with Philippine Law:** The template is designed to meet all the legal requirements for a valid will in the Philippines, ensuring that your wishes are legally enforceable.

* **User-Friendly Interface:** The template is easy to use, with clear instructions and prompts that guide you through the process of creating your will.

* **Customizable Sections:** The template includes customizable sections that allow you to specify your beneficiaries, distribute your assets, and appoint executors.

* **Provision for Legitime:** The template includes provisions to ensure that the legitime of compulsory heirs is protected, as required by Philippine law.

* **Witness Attestation Clause:** The template includes a witness attestation clause that complies with the requirements for notarial wills.

* **Holographic Will Option:** The template also includes guidance on creating a holographic will, which is entirely handwritten, dated, and signed by the testator.

* **Expert Legal Support:** LegalEase PH offers expert legal support to assist you with any questions or concerns you may have about the template or the estate planning process.

For example, the customizable sections allow you to specify exactly who receives which assets. Let’s say Freddie Aguilar wanted to leave his guitars to aspiring musicians; this template enables that level of specificity, preventing potential disputes.

Significant Advantages, Benefits & Real-World Value of Using the LegalEase PH Will Template

The Philippine Legal Will Template by LegalEase PH offers numerous advantages:

* **Cost-Effective:** Creating a will with this template is significantly more affordable than hiring an attorney.

* **Convenient:** You can create your will from the comfort of your own home, at your own pace.

* **Peace of Mind:** Knowing that you have a legally sound will can provide peace of mind and ensure that your wishes are honored.

* **Protection for Loved Ones:** A well-drafted will can protect your loved ones and prevent potential conflicts among them.

* **Reduced Estate Taxes:** Proper planning with the template can help minimize estate taxes payable upon your death.

Users consistently report that the template’s clarity and ease of use significantly reduce the stress associated with estate planning. Our analysis reveals that using the template can save hundreds or even thousands of pesos compared to traditional legal fees.

Comprehensive & Trustworthy Review of LegalEase PH’s Philippine Legal Will Template

The LegalEase PH Philippine Legal Will Template offers a valuable service for individuals seeking to create their own wills without the high cost of hiring a lawyer. However, it’s crucial to approach it with a balanced perspective.

**User Experience & Usability:** The template is designed with a user-friendly interface, making it relatively easy to navigate. The instructions are clear and concise, guiding users through each section of the will-creation process. The fill-in-the-blank format simplifies the process for those without legal expertise.

**Performance & Effectiveness:** The template is designed to create legally binding documents. However, its effectiveness depends on the user’s accuracy in providing information and adhering to the instructions. It’s essential to ensure all details are correct and that the will is properly executed according to Philippine law.

**Pros:**

1. **Affordable:** Significantly cheaper than hiring a lawyer.

2. **User-Friendly:** Easy to navigate and understand, even for non-lawyers.

3. **Convenient:** Can be completed at your own pace, from the comfort of your home.

4. **Customizable:** Allows for personalization to fit individual needs.

5. **Comprehensive:** Covers essential aspects of will creation, including asset distribution and executor appointment.

**Cons/Limitations:**

1. **Requires User Accuracy:** The effectiveness depends on the user’s accuracy in providing information.

2. **May Not Cover Complex Situations:** The template may not be suitable for complex estate planning scenarios.

3. **No Legal Advice Included:** The template does not provide legal advice, and users may need to seek separate consultation for specific issues.

4. **Potential for Errors:** Without legal expertise, users may make errors that invalidate the will.

**Ideal User Profile:** This template is best suited for individuals with relatively simple estate planning needs and a basic understanding of legal terminology. It’s ideal for those who want to create a will quickly and affordably.

**Key Alternatives:**

* **Hiring an Attorney:** Provides personalized legal advice and ensures the will is tailored to your specific needs.

* **Online Legal Services:** Offers a hybrid approach, combining online tools with access to legal professionals.

**Expert Overall Verdict & Recommendation:** The LegalEase PH Philippine Legal Will Template is a valuable tool for basic estate planning. However, it’s crucial to approach it with caution and to seek legal advice if you have complex needs or are unsure about any aspect of the will-creation process. We recommend it for straightforward situations but advise consulting an attorney for more complicated estates.

Insightful Q&A Section

Here are some frequently asked questions about last wills and testaments in the Philippines:

1. **What happens if I die without a will in the Philippines?**

*If you die without a will (intestate), your estate will be distributed according to the laws of intestacy in the Civil Code. This typically favors your surviving spouse and children.*

2. **Can I disinherit my child in the Philippines?**

*Disinheritance is possible but requires legal cause, as outlined in the Civil Code. You must prove that your child committed a specific act that warrants disinheritance.*

3. **What is the difference between a notarial will and a holographic will?**

*A notarial will is prepared and signed in the presence of a notary public and three witnesses, while a holographic will is entirely handwritten, dated, and signed by the testator.*

4. **How much does it cost to probate a will in the Philippines?**

*The cost of probate depends on the value of the estate and the complexity of the case. It typically includes court fees, attorney’s fees, and publication costs.*

5. **Can I update my will after it has been executed?**

*Yes, you can update your will by creating a codicil (an amendment to the will) or by executing a new will.*

6. **What is an executor, and what are their responsibilities?**

*An executor is the person named in the will to administer the estate. Their responsibilities include collecting assets, paying debts, and distributing the remaining assets to the beneficiaries.*

7. **How long does it take to probate a will in the Philippines?**

*The probate process can take several months to several years, depending on the complexity of the case and the court’s workload.*

8. **Do I need a lawyer to create a will in the Philippines?**

*While it is not legally required, it is highly recommended to consult with an attorney to ensure that your will is valid and that your wishes are properly documented.*

9. **What happens if my witnesses die before I do?**

*The death of a witness does not invalidate a notarial will, provided that the will was properly executed and attested to by the required number of witnesses at the time of signing.*

10. **Are digital wills valid in the Philippines?**

*Currently, digital wills are not explicitly recognized under Philippine law. A physical, signed document is still required.*

Conclusion: Securing Your Legacy with Careful Estate Planning

Understanding the nuances of estate planning, particularly in the context of “freddie aguilar’s last will and testament,” underscores the importance of preparing for the future. While the specifics of his will remain private, the legal framework surrounding estate planning in the Philippines offers valuable lessons for everyone. By taking proactive steps to create a valid will, you can ensure that your assets are distributed according to your wishes, your loved ones are protected, and your legacy is preserved.

Looking ahead, the legal landscape may evolve to incorporate digital assets and online wills. However, for now, a well-drafted, physical will remains the cornerstone of sound estate planning.

To take control of your future and ensure your wishes are honored, consider exploring the LegalEase PH Philippine Legal Will Template or consulting with an experienced estate planning attorney. Share your experiences with estate planning in the comments below, and let’s work together to demystify this crucial aspect of life.