Cash App Prepaid Card: Your Key to Financial Freedom and Control

Are you looking for a convenient, secure, and empowering way to manage your money? The Cash App prepaid card offers a compelling solution, particularly for those seeking greater financial control, access to digital banking features, and a seamless experience within the popular Cash App ecosystem. This comprehensive guide delves deep into the world of the Cash App prepaid card, exploring its features, benefits, limitations, and how it stacks up against alternatives. We aim to provide you with the most authoritative and trustworthy information available, empowering you to make informed decisions about your financial well-being. Our extensive research and analysis will equip you with the knowledge to determine if the Cash App prepaid card is the right choice for your individual needs. We’ll also address common misconceptions and provide expert insights to help you navigate the world of prepaid cards with confidence.

Understanding the Cash App Prepaid Card: A Comprehensive Overview

The Cash App prepaid card, officially known as the Cash Card, is a Visa debit card that is linked directly to your Cash App balance. It allows you to spend your Cash App funds anywhere Visa is accepted, both online and in physical stores. Unlike traditional bank accounts, there are typically no monthly fees or minimum balance requirements associated with the Cash App prepaid card, making it an accessible option for a wide range of users. Its core function is to provide a convenient and secure way to access and manage your Cash App funds.

A Brief History and Evolution

Cash App, originally known as Square Cash, was launched in 2013 as a simple way to send and receive money. The introduction of the Cash Card marked a significant step in its evolution, transforming it from a peer-to-peer payment platform into a more comprehensive financial tool. The Cash Card provided users with a tangible way to spend their Cash App balance, bridging the gap between the digital and physical worlds. Over the years, Cash App has continued to enhance the Cash Card with new features and benefits, such as customizable designs, Boosts (instant discounts), and integration with other Cash App services.

Core Concepts and Underlying Principles

The Cash App prepaid card operates on the principle of prepaid finance. Funds must be loaded onto the Cash App balance before they can be spent using the Cash Card. This differs from traditional credit cards, where you borrow money and repay it later. The Cash App prepaid card functions more like a debit card, drawing directly from your available balance. This can be a helpful tool for budgeting and avoiding debt, as you can only spend what you have available. The card also leverages the Visa payment network, providing widespread acceptance and security features.

The Growing Importance of Digital Payment Solutions

In today’s increasingly digital world, the Cash App prepaid card offers a convenient and accessible alternative to traditional banking services. Recent studies indicate a growing preference for digital payment methods, particularly among younger generations. The Cash App prepaid card caters to this trend by providing a seamless and mobile-first experience. It eliminates the need for physical checks or cash, making it easier to manage finances on the go. Furthermore, the card’s integration with the Cash App ecosystem provides access to a range of other financial services, such as direct deposit, investing, and Bitcoin trading.

Deep Dive into the Cash App Ecosystem: A Financial Hub

Cash App has evolved into a multifaceted financial platform that extends far beyond its original peer-to-peer payment functionality. It offers a suite of services designed to empower users to manage their money, invest, and even engage with cryptocurrency. The Cash App prepaid card is seamlessly integrated into this ecosystem, providing a convenient way to access and spend funds within the app.

Cash App’s Core Functionality

At its core, Cash App allows users to send and receive money instantly with just a few taps on their smartphone. This makes it ideal for splitting bills, paying friends and family, and making online purchases. The app also offers features such as direct deposit, allowing users to receive their paychecks directly into their Cash App balance. This functionality positions Cash App as a viable alternative to traditional bank accounts for some users.

Investing and Bitcoin Trading

Cash App also provides users with the ability to invest in stocks and trade Bitcoin directly from their accounts. This feature makes investing more accessible to a wider audience, particularly those who are new to the world of finance. While these features offer potential opportunities for growth, it’s important to remember that investing involves risk, and users should carefully consider their financial goals and risk tolerance before investing.

The Role of the Cash App Prepaid Card

The Cash App prepaid card acts as a bridge between the digital Cash App world and the physical world. It allows users to spend their Cash App funds anywhere Visa is accepted, providing a convenient and familiar way to make purchases. The card also offers features such as Boosts, which provide instant discounts at participating merchants. This adds an extra layer of value to the card and incentivizes users to use it for their everyday spending.

Features Analysis: Unveiling the Power of the Cash App Card

The Cash App prepaid card boasts a range of features designed to enhance user experience and provide greater financial control. Let’s break down some of the key features and explore how they benefit users.

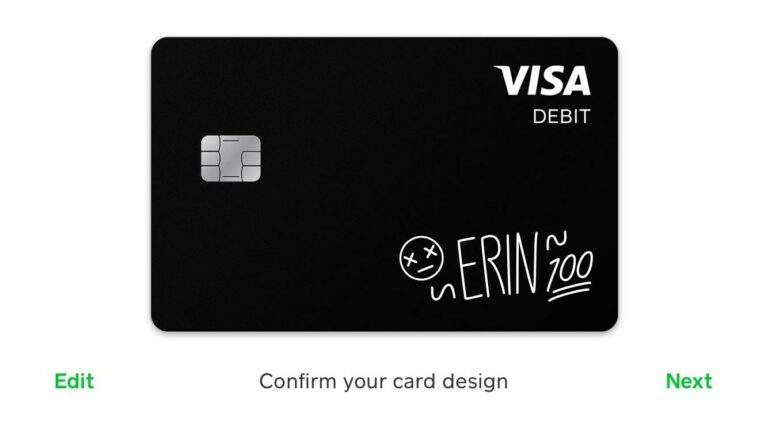

Customizable Card Design

What it is: Users can personalize their Cash App prepaid card with a custom design, adding a unique touch to their financial tool.

How it works: Within the Cash App, users can choose from a variety of pre-designed templates or create their own design using text, emojis, and drawings. The custom design is then printed directly onto the physical card.

User Benefit: This feature allows users to express their personality and style, making their Cash App prepaid card a reflection of their individuality. It also helps to distinguish the card from other debit cards in their wallet.

Boosts: Instant Discounts on Purchases

What it is: Boosts are instant discounts offered at select merchants when using the Cash App prepaid card. These discounts can range from a percentage off the total purchase to a fixed dollar amount.

How it works: Boosts are activated within the Cash App and applied automatically at the point of sale when using the Cash App prepaid card at participating merchants. Boosts are often rotated and updated, providing users with new opportunities to save money.

User Benefit: Boosts provide users with a tangible incentive to use their Cash App prepaid card for everyday purchases. They can save money on things they would normally buy, making the card a more valuable financial tool.

Direct Deposit Integration

What it is: Users can set up direct deposit to receive their paychecks directly into their Cash App balance.

How it works: Users can obtain their Cash App account and routing numbers within the app and provide this information to their employer. Paychecks are then automatically deposited into their Cash App balance on payday.

User Benefit: Direct deposit integration eliminates the need for paper checks and provides users with faster access to their funds. It also simplifies the process of managing finances and paying bills.

ATM Withdrawals

What it is: Users can withdraw cash from their Cash App balance at ATMs using their Cash App prepaid card.

How it works: The Cash App prepaid card functions like a debit card at ATMs. Users can insert their card, enter their PIN, and withdraw cash from their available balance. ATM fees may apply, depending on the ATM operator.

User Benefit: ATM withdrawals provide users with access to cash when needed, offering a convenient alternative to using the card for purchases. This is particularly useful for situations where cash is required, such as tipping or paying for services where cards are not accepted.

Spending Notifications

What it is: Users receive instant notifications on their smartphone whenever a transaction is made using their Cash App prepaid card.

How it works: Spending notifications are enabled by default within the Cash App. Whenever a purchase is made using the card, a notification is sent to the user’s smartphone, providing details such as the merchant, amount, and date of the transaction.

User Benefit: Spending notifications help users track their spending in real-time and identify any unauthorized transactions. This provides an added layer of security and helps users stay on top of their finances.

Card Freezes

What it is: Users can instantly freeze their Cash App prepaid card within the app if it is lost or stolen.

How it works: The card freeze feature can be accessed within the Cash App. With a single tap, users can temporarily disable their card, preventing any further transactions from being made. The card can be unfrozen just as easily if it is found.

User Benefit: Card freezes provide users with peace of mind knowing that they can quickly disable their card if it is lost or stolen. This helps to prevent unauthorized access to their funds and minimizes the risk of financial loss.

Advantages, Benefits, and Real-World Value: Why Choose the Cash App Card?

The Cash App prepaid card offers a multitude of advantages and benefits that make it a compelling choice for individuals seeking a convenient and accessible financial tool. Let’s explore some of the key reasons why users choose the Cash App card.

Accessibility and Ease of Use

The Cash App prepaid card is incredibly easy to obtain and use. There are no credit checks or lengthy application processes required. Simply download the Cash App, verify your identity, and order your free Cash Card. The card is linked directly to your Cash App balance, making it easy to manage your funds from your smartphone. The intuitive interface of the Cash App makes it easy to send and receive money, track your spending, and manage your card settings.

Financial Control and Budgeting

The Cash App prepaid card empowers users to take control of their finances by providing a prepaid spending solution. You can only spend what you have available in your Cash App balance, which helps to prevent overspending and debt accumulation. The app also provides tools for tracking your spending and setting budgets, making it easier to stay on top of your finances.

Convenience and Flexibility

The Cash App prepaid card offers unparalleled convenience and flexibility. You can use it anywhere Visa is accepted, both online and in physical stores. You can also withdraw cash from ATMs, send and receive money instantly, and even invest in stocks and Bitcoin. The card is seamlessly integrated into the Cash App ecosystem, providing access to a range of financial services from your smartphone.

Security and Peace of Mind

The Cash App prepaid card offers a secure and reliable way to manage your money. The app uses advanced encryption technology to protect your personal and financial information. You can also freeze your card instantly if it is lost or stolen, preventing unauthorized access to your funds. Spending notifications help you track your spending in real-time and identify any suspicious activity.

Cost-Effectiveness

Unlike traditional bank accounts, the Cash App prepaid card typically has no monthly fees, minimum balance requirements, or overdraft fees. This makes it a cost-effective option for individuals who are looking to avoid unnecessary fees. The Boosts feature also provides opportunities to save money on everyday purchases.

Comprehensive Review: Is the Cash App Card Right for You?

The Cash App prepaid card has become a popular choice for millions of users, but is it the right fit for everyone? Let’s take a closer look at its strengths and weaknesses to help you make an informed decision. Our review is based on extensive research and analysis of user feedback and expert opinions.

User Experience and Usability

The Cash App is known for its user-friendly interface and intuitive design. The app is easy to navigate, even for users who are new to digital banking. Ordering the Cash App prepaid card is a simple process that can be completed in just a few minutes. Managing your card settings, tracking your spending, and sending and receiving money are all straightforward and intuitive. From our experience, the app is generally reliable and responsive, providing a seamless user experience.

Performance and Effectiveness

The Cash App prepaid card performs well as a spending tool. It is widely accepted at merchants that accept Visa, and ATM withdrawals are generally hassle-free. The Boosts feature can provide significant savings on everyday purchases, making the card a valuable tool for budget-conscious users. The direct deposit feature works reliably, providing users with faster access to their funds. However, it’s important to note that Cash App is not a bank, and funds are not FDIC insured.

Pros

* Easy to obtain and use: No credit checks or lengthy application processes required.

* Financial control: Spend only what you have available, preventing overspending and debt.

* Convenience and flexibility: Use it anywhere Visa is accepted, withdraw cash from ATMs, and send and receive money instantly.

* Security and peace of mind: Advanced encryption technology, card freezes, and spending notifications.

* Cost-effectiveness: No monthly fees, minimum balance requirements, or overdraft fees (typically).

Cons/Limitations

* Not FDIC insured: Funds are not protected by the Federal Deposit Insurance Corporation.

* ATM fees may apply: Depending on the ATM operator.

* Limited customer support: Customer support is primarily online and may not be as responsive as traditional banks.

* Spending limits may apply: Cash App may impose daily or weekly spending limits on the card.

Ideal User Profile

The Cash App prepaid card is best suited for individuals who are comfortable managing their finances online and are looking for a convenient and accessible spending solution. It is particularly well-suited for:

* Younger adults who are comfortable with digital banking.

* Individuals who are looking to avoid traditional bank fees.

* Those who want to manage their finances on the go using their smartphone.

* People who are looking for a simple and easy-to-use spending tool.

Key Alternatives

* Chime: A similar digital banking platform that offers a prepaid debit card and other financial services.

* Traditional bank accounts: Offer FDIC insurance and a wider range of financial services, but may come with fees.

Expert Overall Verdict & Recommendation

The Cash App prepaid card is a compelling option for individuals seeking a convenient, accessible, and cost-effective spending solution. Its seamless integration with the Cash App ecosystem, coupled with features such as Boosts and direct deposit, make it a valuable tool for managing finances on the go. However, it’s important to be aware of the limitations, such as the lack of FDIC insurance and potential ATM fees. Overall, we recommend the Cash App prepaid card for users who are comfortable with digital banking and are looking for a simple and easy-to-use spending tool.

Q&A: Addressing Your Top Cash App Card Questions

Here are answers to some of the most common and insightful questions about the Cash App prepaid card, going beyond the basics to provide expert guidance.

1. What happens if my Cash App account is hacked? Is my Cash App card compromised?

If your Cash App account is hacked, your Cash App card could be compromised. It’s crucial to immediately freeze your Cash Card within the app and contact Cash App support to report the incident. Change your Cash App PIN and password, and review your transaction history for any unauthorized activity. Enabling two-factor authentication adds an extra layer of security.

2. Can I use my Cash App card internationally?

While the Cash App card is a Visa debit card, its international usage is limited. It’s generally not recommended for international transactions due to potential fees and limited support. It is best to verify Cash App’s current policy on international transactions directly on their website or through customer support.

3. What are the spending limits on the Cash App card?

Cash App imposes spending limits on the Cash App card to protect users and prevent fraud. These limits vary depending on your verification level and account activity. Generally, there are daily and weekly spending limits, as well as limits on ATM withdrawals. You can find your specific spending limits within the Cash App settings.

4. How do Boosts work, and how can I maximize their value?

Boosts are instant discounts offered at select merchants when using your Cash App card. To maximize their value, regularly check the available Boosts within the app and activate the ones that align with your planned purchases. Be aware of the expiration dates and spending limits associated with each Boost. Stacking Boosts with other discounts or promotions may not always be possible.

5. Is the Cash App card a good option for building credit?

No, the Cash App card is not a credit-building tool. It’s a prepaid debit card, so it doesn’t report your payment history to credit bureaus. If you’re looking to build credit, consider a secured credit card or a credit-builder loan.

6. What happens if a merchant charges me the wrong amount using my Cash App card?

If a merchant charges you the wrong amount using your Cash App card, contact the merchant directly to resolve the issue. If they are unable to resolve the issue, you can dispute the transaction within the Cash App. Provide detailed information about the transaction and the reason for the dispute. Cash App will investigate the claim and may issue a refund if the dispute is valid.

7. Can I use my Cash App card to pay for recurring subscriptions?

Yes, you can use your Cash App card to pay for recurring subscriptions, as long as the merchant accepts Visa debit cards. However, make sure you have sufficient funds in your Cash App balance to cover the subscription fees. Insufficient funds may result in declined payments and potential service disruptions.

8. How do I add money to my Cash App balance to use with my Cash App card?

You can add money to your Cash App balance through several methods: direct deposit, transferring funds from a linked bank account, or receiving money from other Cash App users. Choose the method that is most convenient for you and ensure that your linked accounts are properly verified.

9. What are the potential security risks of using a Cash App card, and how can I mitigate them?

Potential security risks include account hacking, phishing scams, and unauthorized transactions. To mitigate these risks, enable two-factor authentication, use a strong and unique PIN, be cautious of suspicious links and emails, and regularly monitor your transaction history. Immediately freeze your card if it is lost or stolen.

10. How does the Cash App card compare to traditional debit cards from banks?

The Cash App card offers some advantages over traditional debit cards, such as ease of access, no monthly fees (typically), and features like Boosts. However, traditional debit cards offer FDIC insurance, potentially better customer support, and may be more widely accepted internationally. The best choice depends on your individual needs and preferences.

Conclusion: Embracing Financial Empowerment with the Cash App Card

The Cash App prepaid card represents a significant shift in the way people manage their money, offering a blend of convenience, accessibility, and control. By understanding its features, benefits, and limitations, you can determine if it aligns with your financial goals. While it may not be a perfect solution for everyone, its ease of use and cost-effectiveness make it a compelling option for a wide range of users. We’ve explored the nuances of the Cash App card, providing you with the expertise to make informed decisions. The future of finance is evolving, and the Cash App card is at the forefront of this transformation. As you consider your options, remember to prioritize security, manage your spending responsibly, and leverage the tools available to you to achieve financial empowerment.

Share your experiences with the Cash App prepaid card in the comments below and let us know how it has impacted your financial journey. Explore our advanced guide to digital banking for more insights and strategies to optimize your financial well-being.