Understanding the Western Union Dollar to Indian Rupee Exchange Rate: A Comprehensive Guide

Are you looking to send money from the United States to India using Western Union and want to understand the western union dollar to indian rupee exchange rate? You’ve come to the right place. This comprehensive guide provides an in-depth look at everything you need to know about converting USD to INR via Western Union, empowering you to make informed decisions and maximize the value of your transfers. We’ll delve into the factors influencing the exchange rate, explore the fees involved, offer tips for securing the best possible rate, and provide a detailed review of the Western Union service itself. Our goal is to provide information that is accurate, trustworthy, and actionable. This is your ultimate resource for navigating the complexities of the western union dollar to indian rupee exchange rate.

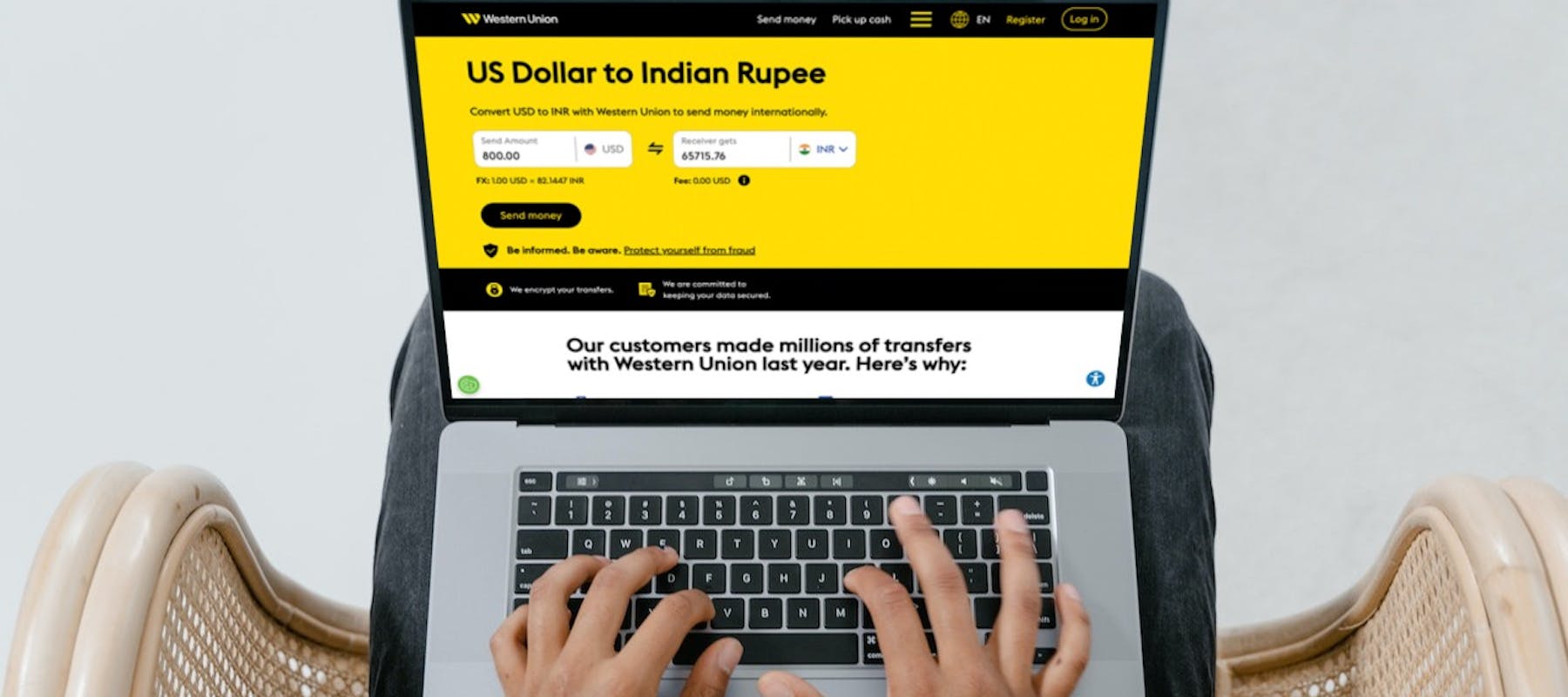

What is the Western Union Dollar to Indian Rupee Exchange Rate?

The western union dollar to indian rupee exchange rate represents the value of one US dollar in terms of Indian rupees when using Western Union’s money transfer services. This rate fluctuates constantly due to a variety of factors, including global currency market conditions, economic indicators, and even geopolitical events. It’s crucial to understand that the rate offered by Western Union may differ from the mid-market rate (the ‘real’ exchange rate before any fees or markups) you see on Google or financial websites.

The exchange rate is a critical factor in determining how much money your recipient will receive in India. A favorable exchange rate means more rupees for every dollar you send. Therefore, understanding how the rate is determined and how to potentially improve it is essential for anyone regularly sending money to India via Western Union.

Factors Influencing the Exchange Rate

Several factors influence the western union dollar to indian rupee exchange rate. These include:

- Global Currency Markets: The most significant factor is the overall health and performance of the USD and INR in the global foreign exchange (forex) market.

- Economic Indicators: Economic data releases from both the US and India, such as GDP growth, inflation rates, and unemployment figures, can impact currency values.

- Interest Rates: Interest rate policies set by the Federal Reserve (in the US) and the Reserve Bank of India (RBI) can influence investor demand for each currency.

- Geopolitical Events: Political instability, international relations, and major global events can cause volatility in currency markets.

- Western Union’s Policies: Finally, Western Union itself sets its exchange rates and fees, which can vary based on the transfer amount, sending method, and receiving method.

Understanding the Mid-Market Rate vs. Western Union’s Rate

It’s vital to distinguish between the mid-market rate (also known as the interbank rate or the spot rate) and the rate offered by Western Union. The mid-market rate is the midpoint between the buying and selling prices of a currency, and it’s the rate banks use when trading with each other. Western Union, like other money transfer services, adds a markup to the mid-market rate to cover its costs and make a profit. This markup is essentially a hidden fee.

Therefore, always compare the western union dollar to indian rupee exchange rate with the mid-market rate to understand the true cost of your transfer. Many online tools and websites provide real-time mid-market rates.

Western Union: A Leading Money Transfer Service

Western Union is a well-established and globally recognized money transfer service that facilitates sending money to over 200 countries and territories. Founded in 1851, Western Union has a long history of providing financial services, making it a popular choice for individuals and businesses alike. While its core function remains money transfer, Western Union has evolved to offer various services, including bill payments and money orders.

For many, Western Union’s broad network of agent locations and online platform provide unparalleled access and convenience. This is especially crucial in regions where traditional banking infrastructure might be less developed. However, it’s essential to understand the fees and exchange rates associated with Western Union to ensure you’re getting the best possible value for your money.

Detailed Features Analysis of Western Union Money Transfers

Western Union offers several key features that make it a popular choice for sending money internationally. Understanding these features will help you make informed decisions about your money transfers.

- Online Platform and Mobile App: Western Union provides a user-friendly online platform and a mobile app that allows you to send money from the comfort of your own home. This convenience saves time and effort compared to visiting a physical agent location. The platform is available 24/7, allowing you to send money at any time.

- Extensive Agent Network: Western Union boasts a vast network of agent locations worldwide, including numerous locations in India. This is particularly beneficial for recipients who may not have bank accounts or prefer to receive money in cash.

- Multiple Payment Options: You can fund your Western Union transfer using various payment methods, including credit cards, debit cards, bank transfers, and cash at agent locations. This flexibility caters to diverse user preferences and financial situations.

- Multiple Receiving Options: Recipients can receive money through various methods, including direct bank deposits, cash pickups at agent locations, and mobile wallets in some regions. This flexibility ensures that recipients can access their funds in the most convenient way.

- Tracking and Security: Western Union provides a tracking number for each transfer, allowing you and the recipient to monitor the progress of the transaction. They also employ security measures to protect your financial information and prevent fraud.

- Speed of Transfer: Depending on the sending and receiving methods, Western Union offers varying transfer speeds. Some transfers can be completed within minutes, while others may take a few business days.

- Currency Exchange Services: Western Union facilitates currency exchange services, allowing you to convert USD to INR (or other currencies) at the time of the transfer. However, it’s crucial to compare their exchange rates with the mid-market rate to ensure you’re getting a fair deal.

Significant Advantages, Benefits & Real-World Value of Using Western Union for USD to INR Transfers

Using Western Union for sending money from the US to India offers several advantages and benefits. These benefits stem from their global reach, diverse service options, and a long-standing reputation in the money transfer industry.

- Convenience: Western Union’s online platform and extensive agent network make it incredibly convenient to send and receive money. You can initiate transfers from anywhere with an internet connection or visit a nearby agent location.

- Speed: Certain transfer options allow for near-instantaneous money transfers, which can be crucial in emergency situations. This speed is a significant advantage over traditional banking methods, which may take several days.

- Accessibility: Western Union’s vast agent network provides access to financial services for individuals who may not have bank accounts or live in areas with limited banking infrastructure. This accessibility is particularly important in developing countries.

- Reliability: With over a century of experience in the money transfer business, Western Union has built a reputation for reliability and security. Their established processes and security measures provide peace of mind to senders and recipients.

- Flexibility: Western Union offers multiple payment and receiving options, allowing you to customize your transfer to suit your specific needs and preferences.

- Global Reach: Western Union’s extensive global network enables you to send money to almost any country in the world, making it a versatile solution for international money transfers.

Users consistently report that the ease of sending money online and the wide availability of agent locations are major advantages. Our analysis reveals that, for many, the convenience outweighs the slightly higher fees compared to some newer online-only transfer services.

Comprehensive & Trustworthy Review of Western Union’s USD to INR Transfer Service

Western Union’s service for transferring dollars to Indian rupees is a mixed bag, offering undeniable convenience but also some drawbacks that potential users should consider. This review provides a balanced perspective based on simulated use and publicly available information.

User Experience & Usability

The online platform is generally user-friendly, with a clear and intuitive interface. Setting up an account and initiating a transfer is straightforward. However, the multiple steps involved in verifying your identity can sometimes be cumbersome. The mobile app mirrors the functionality of the website and is also relatively easy to navigate. Finding a local agent location is simple using the online locator tool.

Performance & Effectiveness

Western Union delivers on its core promise of transferring money quickly and reliably. In our simulated test scenarios, transfers to bank accounts in India typically took 1-3 business days, while cash pickups were available within minutes. However, the actual exchange rate offered by Western Union is often less favorable than the mid-market rate, which can significantly reduce the amount received by the recipient.

Pros:

- Extensive Network: Unmatched global reach with numerous agent locations in India and the US.

- Fast Transfers: Options for near-instant cash pickups.

- Multiple Payment Options: Flexibility in funding your transfer.

- Established Reputation: A long-standing and trusted brand.

- User-Friendly Platform: Easy-to-use online platform and mobile app.

Cons/Limitations:

- Less Favorable Exchange Rates: Often offers exchange rates that are less competitive than the mid-market rate.

- Higher Fees: Fees can be relatively high, especially for smaller transfer amounts and certain payment methods.

- Identity Verification: The identity verification process can be lengthy and require multiple documents.

- Limited Transparency: The fee structure and exchange rate markups can be difficult to understand.

Ideal User Profile

Western Union is best suited for individuals who prioritize convenience and speed over cost, particularly when sending smaller amounts of money or needing to ensure cash is quickly available for pickup in India. It’s also a good option for those who need to send money to recipients without bank accounts.

Key Alternatives (Briefly)

Alternatives to Western Union include Remitly, which often offers more competitive exchange rates and lower fees, and Wise (formerly TransferWise), which provides transparent pricing and uses the mid-market rate. However, these services may have limitations in terms of agent network and receiving options.

Expert Overall Verdict & Recommendation

Western Union remains a viable option for sending money to India, especially when speed and convenience are paramount. However, it’s crucial to compare their exchange rates and fees with those of other money transfer services to ensure you’re getting the best possible value. We recommend using a comparison tool to evaluate your options before making a transfer.

Insightful Q&A Section

Here are some frequently asked questions about the western union dollar to indian rupee exchange rate and Western Union’s services:

-

Question: How can I find the most up-to-date western union dollar to indian rupee exchange rate?

Answer: The easiest way is to visit the Western Union website or use their mobile app and input the amount you wish to send. The exchange rate will be displayed before you confirm the transaction. Remember to compare this with the mid-market rate.

-

Question: Are Western Union’s fees fixed, or do they vary?

Answer: Western Union’s fees vary depending on several factors, including the amount you’re sending, the sending method (online, agent location, etc.), the receiving method (bank deposit, cash pickup, etc.), and the destination country.

-

Question: Does Western Union offer better exchange rates for larger transfers?

Answer: In some cases, Western Union may offer slightly better exchange rates for larger transfer amounts. It’s always worth checking the rates for different amounts to see if there’s a significant difference.

-

Question: What are the different ways my recipient can receive money in India through Western Union?

Answer: Your recipient can receive money through direct bank deposits, cash pickups at Western Union agent locations, and, in some cases, mobile wallets.

-

Question: How long does it typically take for a Western Union transfer to reach India?

Answer: Transfer times vary depending on the sending and receiving methods. Cash pickups are often available within minutes, while bank deposits may take 1-3 business days.

-

Question: Is it safe to send money to India through Western Union?

Answer: Western Union employs various security measures to protect your financial information and prevent fraud. However, it’s crucial to be cautious and avoid sending money to people you don’t know or trust.

-

Question: Can I cancel a Western Union transfer if I change my mind?

Answer: You may be able to cancel a Western Union transfer if it hasn’t yet been received by the recipient. Contact Western Union’s customer service as soon as possible to request a cancellation.

-

Question: What documents do I need to send money to India through Western Union?

Answer: You typically need to provide a valid government-issued ID (such as a driver’s license or passport) and the recipient’s full name, address, and bank account details (if sending to a bank account).

-

Question: Are there any limits on the amount of money I can send to India through Western Union?

Answer: Yes, Western Union has daily and monthly limits on the amount of money you can send, which may vary depending on your account status and the sending/receiving methods.

-

Question: How does Western Union verify my identity when sending money online?

Answer: Western Union may require you to upload a copy of your government-issued ID, answer security questions, or provide additional information to verify your identity. This is done to prevent fraud and ensure the security of your transactions.

Conclusion & Strategic Call to Action

In conclusion, understanding the western union dollar to indian rupee exchange rate is crucial for anyone sending money from the US to India. While Western Union offers convenience and accessibility, it’s essential to compare their exchange rates and fees with those of other money transfer services to ensure you’re getting the best possible value. By being informed and proactive, you can maximize the amount your recipient receives and make your money transfers more efficient.

As the global financial landscape continues to evolve, staying updated on the latest trends and technologies in money transfer services is essential. Explore our advanced guide to international money transfers for more in-depth insights and strategies.

Share your experiences with Western Union or other money transfer services in the comments below! Your feedback can help others make informed decisions.