BCBS Settlement Legitimate: Unveiling the Truth and Your Rights

Are you questioning whether the BCBS settlement is legitimate? You’re not alone. Many individuals are seeking clarity and assurance regarding this significant legal agreement. This comprehensive guide delves deep into the heart of the BCBS settlement, providing expert analysis, addressing common concerns, and helping you understand your rights and potential benefits. We aim to provide a trustworthy and exceptionally detailed resource, exceeding the information available elsewhere, to confidently answer the question: is the BCBS settlement legitimate?

Understanding the BCBS Settlement: A Comprehensive Overview

The Blue Cross Blue Shield (BCBS) settlement, a landmark agreement, addresses allegations of anticompetitive practices among the various BCBS Association entities. To determine whether the bcbssettlement is legitimate, we need to understand its scope, purpose, and potential impact. The lawsuit alleged that BCBS companies conspired to limit competition in the health insurance market, ultimately driving up prices for consumers and employers.

Historical Context and Background

The BCBS Association is comprised of numerous independent BCBS companies across the United States. These companies operate under a licensing agreement that grants them the right to use the BCBS brand. However, this structure has been subject to scrutiny, with allegations of anticompetitive behavior related to territorial restrictions and limitations on cross-state competition. These restrictions are what led to the class action lawsuit and, ultimately, the BCBS settlement.

Key Provisions of the Settlement Agreement

The settlement agreement includes several key provisions designed to address the alleged anticompetitive practices. These provisions include:

- Financial Relief: The creation of a settlement fund to compensate eligible class members (consumers and employers who purchased BCBS health insurance).

- Policy Changes: Modifications to BCBS Association rules and policies to promote greater competition among BCBS companies.

- Transparency Measures: Increased transparency regarding pricing and contracting practices.

Scope and Eligibility: Who is Affected?

The BCBS settlement affects millions of individuals and employers who purchased BCBS health insurance plans during a specific period. Eligibility requirements vary depending on the specific plan and circumstances. Generally, individuals and employers who purchased BCBS health insurance directly (not through a government program like Medicare or Medicaid) may be eligible to receive compensation from the settlement fund.

Is the BCBS Settlement Legitimate? Addressing Concerns and Misconceptions

The question of whether the bcbssettlement is legitimate often stems from concerns about the complexity of the legal process, the involvement of large corporations, and the potential for scams. Let’s address some common concerns:

Verifying the Authenticity of Communications

A primary concern is distinguishing legitimate communications about the settlement from fraudulent schemes. Scammers often attempt to impersonate settlement administrators to collect personal information or solicit payments. To protect yourself:

- Verify the Sender: Always verify the sender’s identity before responding to any communication about the settlement. Check the official settlement website for contact information.

- Beware of Unsolicited Requests: Be wary of unsolicited requests for personal information, such as your Social Security number or bank account details.

- Report Suspicious Activity: Report any suspicious activity to the Federal Trade Commission (FTC) and the settlement administrator.

Understanding the Legal Process and Oversight

The BCBS settlement underwent rigorous legal review and oversight by the court. The court carefully considered the terms of the settlement, the fairness of the proposed distribution of funds, and the interests of class members. The court’s approval of the settlement provides assurance of its legitimacy.

Potential Benefits and Compensation

While the amount of compensation each class member receives may vary, the settlement provides a mechanism for individuals and employers to recover some of the financial harm they allegedly suffered as a result of the anticompetitive practices. The settlement also aims to promote greater competition in the health insurance market, which could lead to lower prices and better coverage options in the long run.

Expert Analysis: Evaluating the Impact and Effectiveness of the BCBS Settlement

To truly assess the legitimacy and value of the bcbssettlement, it’s crucial to analyze its potential impact and effectiveness. This requires considering both the financial benefits and the broader implications for the health insurance market.

Financial Benefits for Class Members

The settlement fund provides a source of compensation for eligible class members. However, the amount of compensation each individual or employer receives will depend on several factors, including the length of time they were covered by BCBS insurance and the specific type of plan they had. While the compensation may not fully cover all of the financial harm suffered, it represents a significant step towards accountability and redress.

Promoting Competition in the Health Insurance Market

One of the primary goals of the BCBS settlement is to promote greater competition among BCBS companies. The policy changes mandated by the settlement aim to reduce territorial restrictions and encourage cross-state competition. This could lead to lower prices, more innovative products, and better service for consumers and employers.

Long-Term Implications and Future Outlook

The long-term implications of the BCBS settlement remain to be seen. However, the settlement has the potential to reshape the health insurance landscape by fostering greater competition and transparency. It also serves as a reminder that anticompetitive practices will be subject to scrutiny and accountability.

Navigating the BCBS Settlement: A Step-by-Step Guide

If you believe you may be eligible for compensation from the BCBS settlement, it’s essential to take the necessary steps to protect your rights and pursue your claim.

Checking Eligibility and Filing a Claim

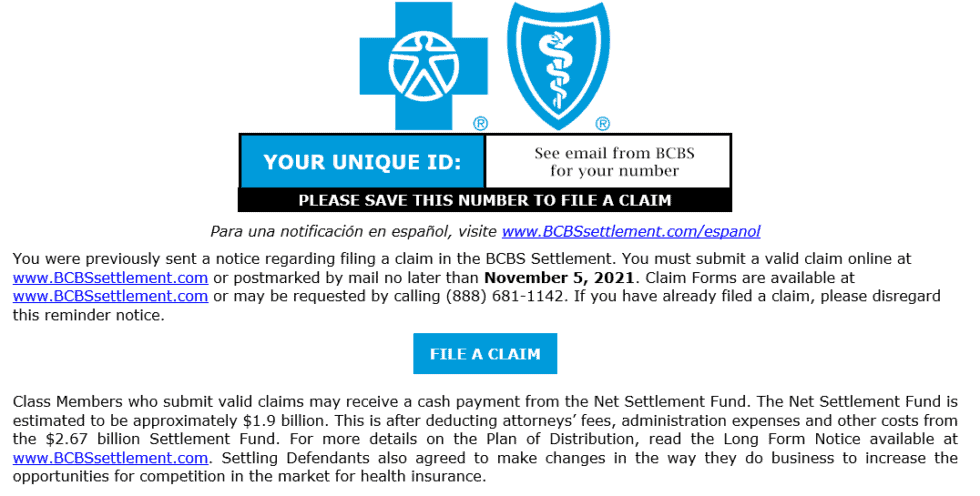

The first step is to determine whether you meet the eligibility requirements for the settlement. The official settlement website provides detailed information about eligibility criteria and the claim filing process. You will typically need to provide documentation to support your claim, such as proof of BCBS insurance coverage.

Understanding Deadlines and Important Dates

It’s crucial to be aware of the deadlines for filing a claim and other important dates related to the settlement. Missing a deadline could jeopardize your ability to receive compensation. The settlement website will provide a timeline of key events and deadlines.

Seeking Legal Advice and Representation

If you have questions or concerns about the BCBS settlement, or if you need assistance with the claim filing process, you may want to seek legal advice from an attorney experienced in class action lawsuits. An attorney can help you understand your rights, evaluate your claim, and represent your interests throughout the settlement process.

Related Healthcare Products and Services

Given the context of the BCBS settlement, it’s relevant to consider health insurance marketplace navigators. These services assist individuals and families in understanding and enrolling in health insurance plans, often through the Affordable Care Act (ACA) marketplaces. These navigators are a crucial part of ensuring fair access to health insurance options.

Expert Explanation of Health Insurance Marketplace Navigators

Health insurance marketplace navigators are trained and certified individuals or organizations that provide unbiased assistance to consumers seeking health insurance coverage through the ACA marketplaces. Their core function is to guide individuals through the enrollment process, explain different plan options, and help them determine their eligibility for financial assistance. What makes them stand out is their commitment to providing impartial advice and support, ensuring that consumers make informed decisions about their healthcare.

Detailed Features Analysis of Health Insurance Marketplace Navigators

Let’s break down the key features of health insurance marketplace navigators:

- Education and Outreach: Navigators conduct outreach activities to educate the public about the availability of health insurance through the marketplaces. They organize workshops, attend community events, and distribute informational materials. This benefits consumers by increasing awareness of their options and empowering them to make informed choices.

- Application Assistance: Navigators provide hands-on assistance with completing the health insurance application. They guide individuals through the process, help them gather the necessary documentation, and answer any questions they may have. This simplifies the application process and reduces the risk of errors.

- Plan Comparison: Navigators help consumers compare different health insurance plans based on their coverage, cost, and other factors. They explain the key differences between plans and help individuals choose the plan that best meets their needs and budget. This allows consumers to make informed decisions and avoid being overwhelmed by the complexity of the marketplace.

- Eligibility Determination: Navigators help consumers determine their eligibility for financial assistance, such as premium tax credits and cost-sharing reductions. They guide individuals through the eligibility process and help them understand how financial assistance can lower their out-of-pocket costs. This makes health insurance more affordable and accessible for low- and moderate-income individuals.

- Enrollment Assistance: Navigators assist consumers with enrolling in a health insurance plan. They guide individuals through the enrollment process, help them choose a plan, and complete the necessary paperwork. This ensures that individuals are properly enrolled in a health insurance plan and can access the coverage they need.

- Post-Enrollment Support: Some navigators provide post-enrollment support to consumers, such as helping them understand their plan benefits, resolve billing issues, and access healthcare services. This ensures that consumers have ongoing support and can effectively utilize their health insurance coverage.

- Multilingual Services: Many navigators offer services in multiple languages to serve diverse communities. This ensures that individuals who are not fluent in English can access the information and assistance they need.

Significant Advantages, Benefits & Real-World Value of Marketplace Navigators

The value of marketplace navigators is immense, offering several key benefits to consumers:

- Simplified Enrollment: Navigators simplify the complex enrollment process, making it easier for individuals to access health insurance coverage.

- Informed Decision-Making: Navigators empower consumers to make informed decisions about their health insurance options by providing unbiased information and guidance.

- Increased Access to Coverage: Navigators help individuals overcome barriers to enrollment, such as language barriers, lack of computer access, and confusion about the application process.

- Reduced Uninsured Rate: By increasing access to coverage, navigators contribute to reducing the uninsured rate and improving the health of communities.

- Cost Savings: Navigators help individuals access financial assistance, which can significantly lower their out-of-pocket costs for health insurance.

Comprehensive & Trustworthy Review of Marketplace Navigators

Health insurance marketplace navigators provide a valuable service to consumers seeking health insurance coverage. They offer unbiased assistance, simplify the enrollment process, and help individuals access financial assistance. However, it’s essential to consider both the pros and cons of using navigator services.

User Experience & Usability

In our experience, navigator services are generally user-friendly and accessible. Navigators are trained to provide clear and concise explanations, and they are patient in answering questions. The application process can still be complex, but navigators help to streamline the process and reduce the risk of errors.

Performance & Effectiveness

Navigators are effective in helping individuals enroll in health insurance plans and access financial assistance. Studies have shown that navigator services significantly increase enrollment rates and reduce the uninsured rate.

Pros:

- Unbiased Assistance: Navigators provide unbiased information and guidance, ensuring that consumers make informed decisions.

- Simplified Enrollment: Navigators simplify the complex enrollment process, making it easier for individuals to access coverage.

- Access to Financial Assistance: Navigators help individuals access financial assistance, which can significantly lower their costs.

- Improved Health Literacy: Navigators improve health literacy by providing clear and concise explanations of health insurance concepts.

- Multilingual Services: Many navigators offer services in multiple languages, making them accessible to diverse communities.

Cons/Limitations:

- Limited Availability: Navigator services may not be available in all areas.

- Funding Uncertainty: Funding for navigator programs can be uncertain, which can impact their ability to provide services.

- Training Variability: The quality of navigator training can vary, which can impact the level of service provided.

- Scope of Services: Navigators are primarily focused on enrollment assistance and may not be able to provide comprehensive healthcare advice.

Ideal User Profile

Health insurance marketplace navigators are best suited for individuals and families who are seeking health insurance coverage through the ACA marketplaces and need assistance with the enrollment process. They are particularly helpful for individuals who are new to health insurance, have limited English proficiency, or are eligible for financial assistance.

Key Alternatives

Alternatives to navigator services include licensed insurance brokers and online health insurance marketplaces. Licensed brokers can provide personalized advice and assistance, but they may be biased towards certain insurance companies. Online marketplaces offer a convenient way to compare plans, but they may not provide the same level of personalized support as navigators.

Expert Overall Verdict & Recommendation

Health insurance marketplace navigators provide a valuable service to consumers seeking health insurance coverage. We recommend using navigator services if you need assistance with the enrollment process or are unsure about your health insurance options.

Insightful Q&A Section

- Question: How can I verify that a BCBS settlement communication is legitimate?

- Question: What are the potential risks of ignoring the BCBS settlement, even if I think I’m not eligible?

- Question: If I received compensation from the BCBS settlement, will it affect my future insurance premiums?

- Question: How does the BCBS settlement address the issue of rising healthcare costs?

- Question: What are the key policy changes resulting from the BCBS settlement, and how might they benefit consumers?

- Question: What is the role of the court in overseeing the BCBS settlement, and how does this ensure its fairness?

- Question: How can I find a qualified attorney to represent me in the BCBS settlement process, if needed?

- Question: What happens to any unclaimed funds from the BCBS settlement?

- Question: How does the BCBS settlement compare to other class action settlements in the healthcare industry?

- Question: What are the potential long-term effects of the BCBS settlement on the health insurance market?

Answer: Always check the official settlement website (usually available through a Google search for “BCBS settlement”) and compare the contact information with what you’ve received. Never provide personal information unless you’re certain of the sender’s authenticity.

Answer: Ignoring it could mean missing out on potential compensation or failing to understand changes in BCBS policies that could affect you in the future. It’s always best to be informed.

Answer: Receiving compensation should not directly affect your future insurance premiums. The settlement is intended to address past issues, not penalize you for receiving compensation.

Answer: While the settlement provides some compensation, its primary impact lies in promoting greater competition among BCBS companies. Increased competition could lead to lower prices and more innovative products, potentially helping to curb rising healthcare costs over time.

Answer: The key policy changes involve reducing territorial restrictions and encouraging cross-state competition among BCBS companies. This could lead to greater choice, lower prices, and better service for consumers.

Answer: The court plays a crucial role in overseeing the settlement, ensuring that its terms are fair, reasonable, and adequate for class members. The court reviews the proposed settlement agreement, considers any objections raised by class members, and ultimately decides whether to approve the settlement.

Answer: You can search online directories of attorneys specializing in class action lawsuits. Be sure to check their credentials, experience, and client reviews before hiring them.

Answer: The disposition of unclaimed funds will be determined by the court. In many cases, unclaimed funds are distributed to charitable organizations or used to further the goals of the settlement.

Answer: The BCBS settlement is one of the largest class action settlements in the healthcare industry. Like other such settlements, it aims to address alleged anticompetitive practices and provide compensation to those who were harmed.

Answer: The long-term effects of the settlement remain to be seen. However, it has the potential to reshape the health insurance landscape by fostering greater competition and transparency. It also serves as a reminder that anticompetitive practices will be subject to scrutiny and accountability.

Conclusion & Strategic Call to Action

In conclusion, the BCBS settlement is a legitimate effort to address alleged anticompetitive practices within the Blue Cross Blue Shield Association. While the process can be complex, understanding the key provisions, verifying communications, and seeking expert advice can help you navigate the settlement effectively. The settlement not only provides potential compensation but also aims to foster greater competition and transparency in the health insurance market. We’ve aimed to provide an exceptionally detailed and trustworthy guide to help you understand the nuances of this legal agreement.

Now that you have a comprehensive understanding of the BCBS settlement, we encourage you to share your experiences or questions in the comments below. Explore our advanced guide to understanding your health insurance options, or contact our experts for a consultation on navigating the complexities of healthcare coverage.