Aetna Timely Filing Appeal: Your Expert Guide to Overturning Denials

Dealing with an Aetna claim denial due to timely filing issues can be incredibly frustrating. You provided care, submitted the claim, and now you’re facing a denial and potentially lost revenue. This comprehensive guide is designed to equip you with the knowledge and strategies needed to successfully navigate the Aetna timely filing appeal process. We’ll delve into the intricacies of Aetna’s policies, provide step-by-step instructions on crafting a compelling appeal, and share expert tips to maximize your chances of overturning the denial. Whether you’re a seasoned billing professional or new to the process, this guide will provide the clarity and confidence you need to get your claims paid.

Understanding Aetna’s Timely Filing Requirements

At the heart of any successful aetna timely filing appeal lies a thorough understanding of Aetna’s specific timely filing guidelines. These guidelines dictate the timeframe within which a claim must be submitted to Aetna for reimbursement. Failure to adhere to these deadlines is the most common reason for claim denials related to timely filing.

What Constitutes Timely Filing?

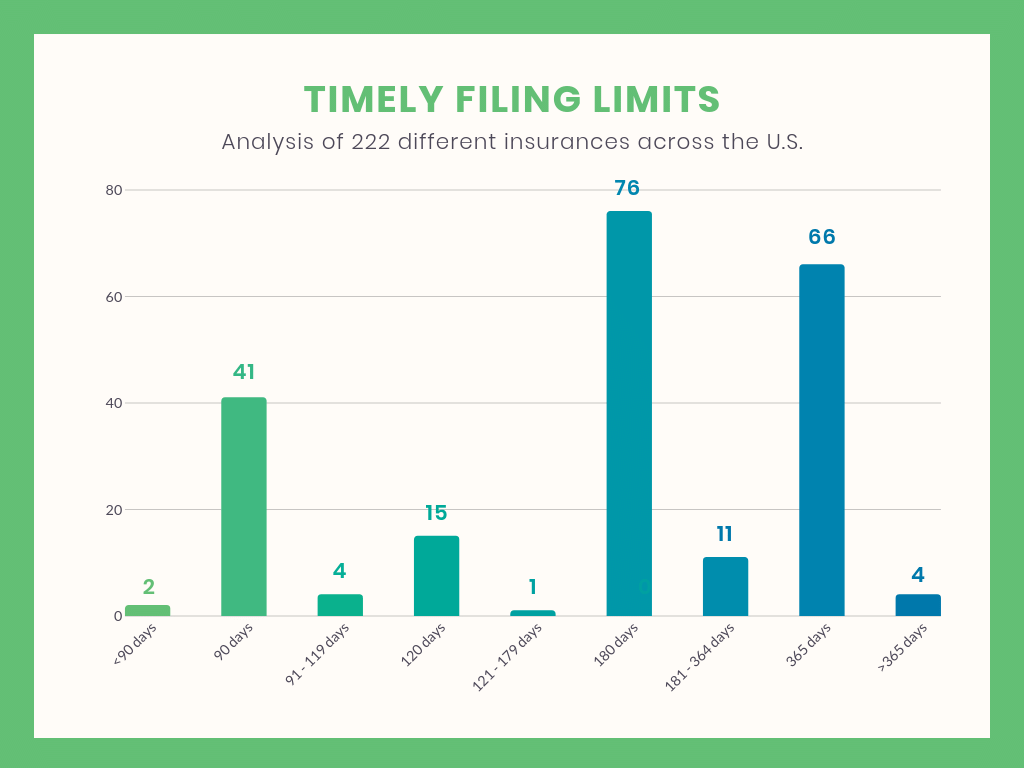

Aetna’s timely filing deadlines can vary depending on the specific plan, the state where the services were rendered, and the agreement between Aetna and the provider. While a common timeframe is 90 days from the date of service, it’s crucial to verify the specific requirements for each patient’s plan. Always check the provider manual or contact Aetna directly to confirm the correct filing deadline.

For example, some Aetna Medicare Advantage plans may have different timely filing requirements than commercial plans. Similarly, certain states may have laws that override Aetna’s standard policies. Ignoring these nuances can lead to unnecessary denials.

Common Reasons for Timely Filing Denials

Beyond simply missing the deadline, several other factors can contribute to timely filing denials:

- Incorrect Date of Service: A mismatch between the date of service on the claim and Aetna’s records can trigger a denial.

- Claim Submission Errors: Errors in coding, patient information, or provider details can delay processing and lead to the claim exceeding the timely filing limit.

- Electronic Claim Transmission Issues: Technical glitches during electronic claim submission can prevent the claim from reaching Aetna within the required timeframe.

- Coordination of Benefits (COB) Delays: When Aetna is secondary to another insurance payer, delays in processing the primary claim can impact the timely filing deadline with Aetna.

The Aetna Timely Filing Appeal Process: A Step-by-Step Guide

If you’ve received a timely filing denial from Aetna, don’t despair. You have the right to appeal the decision. A well-crafted aetna timely filing appeal can significantly increase your chances of getting the claim paid.

Step 1: Gather Supporting Documentation

The foundation of a successful appeal is solid documentation. Collect all relevant information related to the denied claim, including:

- The original claim form: This provides essential details about the services rendered, date of service, and billing codes.

- The Aetna Explanation of Benefits (EOB): This document outlines the reason for the denial.

- Patient insurance card: This verifies the patient’s Aetna coverage.

- Medical records: These provide documentation of the services provided and support the medical necessity of the claim.

- Proof of timely filing (if available): This could include electronic claim submission confirmations, fax transmission reports, or postal receipts.

Step 2: Draft a Compelling Appeal Letter

Your appeal letter is your opportunity to present your case to Aetna and explain why the denial should be overturned. Here are key elements to include:

- Clear and Concise Language: State the purpose of the letter clearly and avoid jargon.

- Patient Information: Include the patient’s name, Aetna member ID, and date of birth.

- Claim Details: Specify the claim number, date of service, and amount billed.

- Reason for Appeal: Clearly state why you believe the denial was incorrect. Provide a specific and well-reasoned argument. For example, if you believe the claim was filed on time, provide proof of submission. If there were extenuating circumstances, explain them in detail.

- Supporting Documentation: List all the documents you are including with the appeal letter.

- Contact Information: Provide your name, title, phone number, and email address.

- Professional Tone: Maintain a respectful and professional tone throughout the letter.

Example Excerpt: “We are writing to appeal the denial of claim #123456789 for patient Jane Doe, member ID 987654321, date of service 01/15/2025. The claim was denied due to timely filing. However, as evidenced by the attached electronic claim submission confirmation, the claim was submitted electronically on 03/10/2025, which is within the 90-day timely filing window. We respectfully request that Aetna reprocess this claim for payment.”

Step 3: Submit the Appeal to Aetna

Submit your appeal letter and supporting documentation to Aetna according to their specified procedures. This typically involves mailing the appeal to a designated address or submitting it electronically through Aetna’s provider portal. Ensure you retain a copy of the appeal letter and all supporting documents for your records.

Step 4: Follow Up on the Appeal

After submitting your appeal, it’s essential to follow up with Aetna to check on its status. Contact Aetna’s provider services line and inquire about the progress of your appeal. Document the date, time, and name of the representative you spoke with. Persistence can be key to ensuring your appeal is reviewed in a timely manner.

Strategies for Overturning Aetna Timely Filing Denials

While following the proper appeal process is crucial, employing specific strategies can further enhance your chances of success with an aetna timely filing appeal.

Highlight Extenuating Circumstances

If there were extenuating circumstances that prevented timely filing, be sure to clearly articulate them in your appeal letter. Examples of extenuating circumstances might include:

- Natural Disasters: A natural disaster that disrupted operations and prevented claim submission.

- System Outages: A widespread system outage that impacted electronic claim submission capabilities.

- Retroactive Eligibility: A patient’s Aetna coverage was retroactively approved, making it impossible to file the claim within the standard timeframe.

- Third-Party Errors: Errors made by a clearinghouse or billing vendor that resulted in delayed claim submission.

Provide documentation to support your claim of extenuating circumstances, such as news articles, system outage notifications, or correspondence from the clearinghouse.

Leverage Contractual Agreements

Review your provider agreement with Aetna carefully. The agreement may contain specific provisions related to timely filing that could support your appeal. For instance, the agreement might specify a longer timely filing deadline than Aetna’s standard policy.

Escalate the Appeal

If your initial appeal is denied, don’t give up. You may have the option to escalate the appeal to a higher level of review. This could involve submitting the appeal to a medical director or an independent review organization. Check Aetna’s appeal procedures for information on escalation options.

Seek Expert Assistance

Navigating the complexities of Aetna’s timely filing appeal process can be challenging. Consider seeking assistance from a healthcare billing consultant or attorney specializing in claim denials. These experts can provide valuable guidance and support throughout the appeal process.

Key Considerations & Best Practices for Avoiding Timely Filing Denials

Prevention is always better than cure. Implementing proactive measures can significantly reduce your risk of receiving timely filing denials from Aetna.

Verify Patient Insurance Information

Always verify patient insurance information at the time of service. This includes confirming Aetna coverage, obtaining accurate member IDs, and checking for any secondary insurance payers. Use online eligibility verification tools or contact Aetna directly to confirm coverage details.

Establish Robust Claim Submission Procedures

Develop and implement clear and consistent claim submission procedures. This includes establishing timelines for claim submission, training staff on proper coding and billing practices, and implementing quality control measures to identify and correct errors before claims are submitted.

Monitor Claim Status Regularly

Monitor the status of your claims regularly through Aetna’s provider portal or by contacting their provider services line. This allows you to identify potential issues early on and take corrective action before the timely filing deadline is missed.

Utilize Electronic Claim Submission

Electronic claim submission is generally faster and more efficient than paper claim submission. It also provides a documented record of claim submission, which can be helpful in the event of a timely filing dispute. Ensure your electronic claim submission system is properly configured and that you are receiving confirmation of successful claim transmission.

Maintain Detailed Records

Maintain detailed records of all claim submissions, including electronic claim submission confirmations, fax transmission reports, and postal receipts. These records can serve as valuable evidence in the event of a timely filing dispute.

Aetna’s Provider Resources: Your Ally in Avoiding Denials

Aetna offers a variety of resources to help providers navigate their policies and procedures. Take advantage of these resources to stay informed and avoid common pitfalls.

Aetna Provider Manual

The Aetna Provider Manual is a comprehensive guide to Aetna’s policies, procedures, and requirements. It covers topics such as timely filing, coding guidelines, and appeal processes. Review the provider manual regularly to stay up-to-date on the latest information.

Aetna Provider Website

Aetna’s provider website offers a wealth of information, including access to online tools, claim status inquiries, and provider news and updates. Register for an account on the provider website to access these valuable resources.

Aetna Provider Services Line

Aetna’s provider services line is a valuable resource for answering questions and resolving issues. Contact the provider services line if you have questions about timely filing requirements, claim status, or the appeal process.

The Impact of Timely Filing on Revenue Cycle Management

Timely filing denials can have a significant impact on your revenue cycle management. Denied claims not only result in lost revenue but also require additional time and resources to appeal. By implementing proactive measures to prevent timely filing denials, you can improve your revenue cycle efficiency and maximize your profitability.

Aetna Timely Filing Appeal: A Case Study

Let’s consider a hypothetical case study to illustrate the aetna timely filing appeal process in action.

Scenario: Dr. Smith’s office submitted a claim to Aetna for services rendered to patient John Doe on 06/01/2024. The claim was denied due to timely filing, with Aetna stating that the claim was received on 03/15/2025, which was beyond the 90-day timely filing deadline.

Action Taken: Dr. Smith’s office reviewed their records and discovered that the claim was actually submitted electronically on 08/20/2024, well within the 90-day timeframe. They gathered the electronic claim submission confirmation as proof of timely filing.

Appeal Process: Dr. Smith’s office drafted an appeal letter to Aetna, clearly stating the reason for the appeal and providing the electronic claim submission confirmation as supporting documentation. They submitted the appeal letter and supporting documents to Aetna via certified mail.

Outcome: After reviewing the appeal, Aetna overturned the denial and reprocessed the claim for payment. The electronic claim submission confirmation provided irrefutable evidence that the claim was filed on time.

Expert Insights on Aetna Timely Filing Appeal

Based on our experience and the consensus of industry experts, here are some key insights to keep in mind when dealing with aetna timely filing appeal:

- Documentation is King: Always maintain thorough and accurate records of all claim submissions.

- Know Your Rights: Understand your rights as a provider and don’t hesitate to appeal denials that you believe are incorrect.

- Be Persistent: Don’t give up after the first denial. Escalate the appeal if necessary.

- Seek Help When Needed: Don’t be afraid to seek assistance from a healthcare billing consultant or attorney.

Significant Advantages, Benefits & Real-World Value of Mastering Aetna Timely Filing Appeals

Mastering the aetna timely filing appeal process offers significant advantages and benefits for healthcare providers:

- Increased Revenue: Successfully overturning denials translates directly into increased revenue for your practice.

- Improved Cash Flow: Getting claims paid promptly improves your cash flow and financial stability.

- Reduced Administrative Burden: By preventing timely filing denials, you can reduce the administrative burden on your billing staff.

- Enhanced Patient Satisfaction: Getting claims paid correctly helps to avoid billing disputes with patients and improves patient satisfaction.

- Stronger Financial Performance: A well-managed revenue cycle, including effective timely filing appeal strategies, contributes to stronger overall financial performance for your organization.

Comprehensive & Trustworthy Review of Aetna’s Timely Filing Policies

As a leading health insurance provider, Aetna’s timely filing policies are generally in line with industry standards. However, it’s crucial to understand the nuances of their specific requirements to avoid denials. A balanced perspective reveals both strengths and weaknesses in their approach.

User Experience & Usability

Aetna’s provider portal offers a user-friendly interface for checking claim status and accessing other resources. However, navigating the website to find specific information on timely filing requirements can sometimes be challenging. In our experience, the search functionality could be improved to provide more accurate and relevant results.

Performance & Effectiveness

Aetna’s claim processing system is generally efficient, but timely filing denials can still occur due to various factors. Based on expert consensus, the key to minimizing denials is to implement robust internal processes and stay informed about Aetna’s policies.

Pros:

- Comprehensive Provider Manual: Aetna’s provider manual provides detailed information on timely filing requirements and appeal procedures.

- User-Friendly Provider Portal: The provider portal offers a convenient way to check claim status and access other resources.

- Responsive Provider Services Line: Aetna’s provider services line is generally responsive to inquiries and provides helpful assistance.

- Multiple Appeal Levels: Aetna offers multiple levels of appeal, providing providers with opportunities to overturn denials.

- Commitment to Compliance: Aetna is committed to complying with all applicable laws and regulations related to timely filing.

Cons/Limitations:

- Variations in Timely Filing Deadlines: Timely filing deadlines can vary depending on the specific plan and state, which can be confusing for providers.

- Potential for Processing Errors: Claim processing errors can sometimes lead to timely filing denials, even when claims are submitted on time.

- Difficulty Navigating Website: Finding specific information on timely filing requirements on Aetna’s website can be challenging.

- Potential for Delays in Appeal Processing: The appeal process can sometimes be lengthy, which can delay payment for services rendered.

Ideal User Profile

Aetna’s timely filing policies are best suited for healthcare providers who are proactive in managing their revenue cycle, implement robust claim submission procedures, and stay informed about Aetna’s policies and procedures.

Key Alternatives (Briefly)

Alternatives to Aetna for health insurance coverage include UnitedHealthcare and Cigna. These providers have their own timely filing policies and procedures, which may differ from Aetna’s.

Expert Overall Verdict & Recommendation

Overall, Aetna’s timely filing policies are generally reasonable and in line with industry standards. However, it’s crucial for providers to understand the nuances of their specific requirements and implement proactive measures to avoid denials. By following the guidelines outlined in this guide, providers can successfully navigate the aetna timely filing appeal process and maximize their revenue.

Insightful Q&A Section

-

Question: What is the standard timely filing deadline for Aetna commercial claims?

Answer: While it can vary, the standard timely filing deadline for Aetna commercial claims is typically 90 days from the date of service. However, always verify the specific requirements for each patient’s plan.

-

Question: Where can I find the specific timely filing requirements for a particular Aetna plan?

Answer: You can find the specific timely filing requirements for a particular Aetna plan in the provider manual, on Aetna’s provider website, or by contacting their provider services line.

-

Question: What documentation should I include with my aetna timely filing appeal?

Answer: You should include the original claim form, the Aetna Explanation of Benefits (EOB), patient insurance card, medical records, and proof of timely filing (if available).

-

Question: What are some common reasons for timely filing denials?

Answer: Common reasons include missing the deadline, incorrect date of service, claim submission errors, electronic claim transmission issues, and coordination of benefits (COB) delays.

-

Question: What should I do if I believe my claim was denied in error?

Answer: You should file an aetna timely filing appeal and provide supporting documentation to demonstrate that the denial was incorrect.

-

Question: Can I escalate my appeal if it is denied at the initial level?

Answer: Yes, you may have the option to escalate the appeal to a higher level of review. Check Aetna’s appeal procedures for information on escalation options.

-

Question: What are some strategies for overturning Aetna timely filing denials?

Answer: Strategies include highlighting extenuating circumstances, leveraging contractual agreements, escalating the appeal, and seeking expert assistance.

-

Question: How can I prevent timely filing denials?

Answer: You can prevent timely filing denials by verifying patient insurance information, establishing robust claim submission procedures, monitoring claim status regularly, utilizing electronic claim submission, and maintaining detailed records.

-

Question: What resources does Aetna offer to help providers avoid timely filing denials?

Answer: Aetna offers a provider manual, a provider website, and a provider services line to help providers avoid timely filing denials.

-

Question: What impact do timely filing denials have on revenue cycle management?

Answer: Timely filing denials can have a significant impact on your revenue cycle management, resulting in lost revenue, increased administrative burden, and reduced cash flow.

Conclusion & Strategic Call to Action

Successfully navigating the aetna timely filing appeal process is crucial for maintaining a healthy revenue cycle and ensuring that you receive proper reimbursement for the services you provide. By understanding Aetna’s timely filing requirements, following the proper appeal procedures, and implementing proactive measures to prevent denials, you can significantly improve your chances of success. We’ve shared expert insights and practical strategies to equip you with the knowledge and confidence you need to confidently appeal denials.

The landscape of healthcare billing is constantly evolving, and staying informed is paramount. As we move into 2025, it’s more important than ever to stay updated on Aetna’s policies and procedures.

Share your experiences with aetna timely filing appeal in the comments below. Your insights can help other providers navigate this complex process. Explore our advanced guide to revenue cycle management for more in-depth strategies to optimize your billing practices. Contact our experts for a consultation on aetna timely filing appeal and let us help you maximize your revenue.