BBLs Measurement Unit Meaning: Unlocking the Oil Industry Standard

Ever wondered what those “bbls” you keep hearing about in oil and gas reports actually mean? You’re not alone! The term “bbls,” short for barrels, is a fundamental unit of measurement in the petroleum industry. Understanding the bbls measurement unit meaning is crucial for anyone involved in or interested in the energy sector, from investors to consumers. This comprehensive guide will delve into the intricacies of this unit, exploring its history, significance, and practical applications. We aim to provide the most in-depth and trustworthy information available, drawing on industry best practices and expert insights.

What Exactly Does ‘BBLs’ Mean? A Deep Dive into the Barrel

At its core, a barrel (bbl) is a unit of volume. However, it’s not just any barrel; it specifically refers to a volumetric unit equivalent to 42 US gallons. This standardized measure is predominantly used to quantify crude oil and other petroleum products. While the term “barrel” evokes images of wooden containers, in modern usage, it’s simply a standard unit of volume, irrespective of the actual physical container.

The origin of this seemingly arbitrary number – 42 gallons – is shrouded in a bit of historical mystery. Some theories suggest it stems from the early days of the oil industry, where 42-gallon wooden barrels were commonly used to transport whiskey and other goods. As the oil industry emerged, these barrels were adopted as a convenient and readily available standard.

Regardless of its exact origins, the 42-gallon barrel has become the globally recognized standard for pricing and trading crude oil. When you see oil prices quoted per barrel, it’s this 42-gallon unit that’s being referenced. Understanding this is paramount to grasping the dynamics of the global energy market.

The Importance of Standardization

The use of a standardized unit like the barrel is critical for several reasons:

- Facilitates Trade: It provides a common language for buyers and sellers, simplifying transactions across different regions and countries.

- Enables Accurate Accounting: It allows for precise tracking of oil production, storage, and transportation.

- Supports Price Discovery: It serves as the basis for benchmark pricing, allowing market participants to assess the value of crude oil.

- Reduces Ambiguity: It eliminates confusion arising from varying container sizes or measurement practices.

The Historical Context of the Oil Barrel

The oil barrel’s history is intrinsically linked to the early days of the petroleum industry in the United States. As oil production began to flourish in the mid-19th century, there was a need for a consistent method of measuring and transporting crude oil. While various sizes of barrels were initially used, the 42-gallon barrel gradually gained prominence.

One popular theory attributes the 42-gallon standard to the Pennsylvania oil fields. Early oil producers often used whiskey barrels, which held 40 gallons. However, to account for leakage and ensure accurate measurement, they added two extra gallons, bringing the total to 42. This practice eventually became formalized and widely adopted.

The Standard Oil Company, under the leadership of John D. Rockefeller, played a significant role in solidifying the 42-gallon barrel as the industry standard. Their dominance in the oil market helped to establish this unit as the de facto measure for crude oil transactions.

Beyond Crude Oil: What Else is Measured in Barrels?

While primarily associated with crude oil, the term “barrel” can also be used to measure other petroleum products, such as:

- Gasoline: A common fuel used in vehicles.

- Diesel: Another fuel used in vehicles, particularly trucks and buses.

- Jet Fuel: Used to power aircraft.

- Heating Oil: Used for residential and commercial heating.

- Other Refined Products: Including lubricants, asphalt, and petrochemical feedstocks.

However, it’s crucial to note that the density and energy content of these products differ from crude oil. Therefore, a barrel of gasoline, for example, will have a different value than a barrel of crude oil. The price per barrel reflects the specific product being traded.

How Accurate are Barrel Measurements?

In the modern oil industry, sophisticated measurement techniques are employed to ensure the accuracy of barrel measurements. These methods include:

- Flow Meters: Devices that measure the volume of fluid flowing through a pipeline.

- Tank Gauges: Instruments used to determine the level of liquid in a storage tank.

- Density Meters: Devices that measure the density of the oil, which is used to convert volume to mass.

These technologies, combined with rigorous calibration and auditing procedures, help to minimize measurement errors and ensure fair trade practices. The American Petroleum Institute (API) and other industry organizations have established standards and guidelines for accurate measurement.

The Role of the Barrel in Global Oil Markets

The barrel serves as the fundamental unit of account in global oil markets. Oil prices are typically quoted in US dollars per barrel (USD/bbl). These prices are influenced by a wide range of factors, including:

- Supply and Demand: The balance between oil production and consumption.

- Geopolitical Events: Political instability or conflicts in oil-producing regions.

- Economic Conditions: Global economic growth or recession.

- Inventory Levels: The amount of oil stored in tanks and pipelines.

- Currency Exchange Rates: The value of the US dollar relative to other currencies.

Understanding these factors and their impact on barrel prices is essential for anyone involved in the oil industry or investing in energy markets.

Oil & Gas Software: Managing BBLs Efficiently

The management of oil and gas resources, measured in BBLs, is a complex undertaking. Oil & Gas software solutions provide critical tools for managing production, storage, transportation, and sales of oil and gas. These systems ensure accurate accounting, regulatory compliance, and optimized decision-making. Modern software solutions integrate data from various sources to provide a comprehensive view of operations.

Key Features of Oil & Gas Software

Oil & Gas software solutions offer a range of features tailored to the specific needs of the industry. Here’s a breakdown of some key functionalities:

Production Management

What it is: This feature tracks oil and gas production from wells, including volume, pressure, and other key parameters.

How it Works: Data is collected from sensors and flow meters at well sites and transmitted to a central database.

User Benefit: Real-time monitoring of production levels enables proactive maintenance and optimization of well performance. By monitoring and optimizing production, companies can increase efficiency and maximize output, directly impacting profitability.

Inventory Management

What it is: This feature manages the storage and movement of oil and gas in tanks, pipelines, and other facilities.

How it Works: Software tracks inventory levels, monitors tank levels, and manages transfers between locations using sophisticated algorithms.

User Benefit: Accurate inventory tracking reduces losses, prevents stockouts, and ensures compliance with regulatory requirements. Efficient inventory management minimizes waste and ensures that product is available when and where it is needed, reducing operational costs.

Transportation Management

What it is: This feature manages the transportation of oil and gas by pipeline, truck, rail, or ship.

How it Works: The system optimizes routes, tracks shipments, and manages logistics to ensure timely and cost-effective delivery.

User Benefit: Optimized transportation reduces costs, minimizes delays, and improves customer satisfaction. By streamlining logistics and reducing transportation costs, companies can improve their bottom line and maintain a competitive edge.

Sales and Marketing

What it is: This feature manages the sales and marketing of oil and gas products.

How it Works: The system tracks customer orders, manages pricing, and generates invoices.

User Benefit: Streamlined sales processes improve customer service, increase sales volume, and maximize revenue. Efficient sales management enables companies to better serve their customers and capitalize on market opportunities, driving revenue growth.

Regulatory Compliance

What it is: This feature ensures compliance with environmental, safety, and other regulations.

How it Works: The system tracks regulatory requirements, generates reports, and manages audits.

User Benefit: Compliance with regulations avoids penalties, protects the environment, and enhances corporate reputation. Adhering to regulations and maintaining high safety standards protects the environment and enhances the company’s reputation, contributing to long-term sustainability.

Advantages of Oil & Gas Software: Maximizing Efficiency

The implementation of Oil & Gas software yields significant advantages, fundamentally altering how companies manage their operations. These advantages directly translate to increased efficiency, reduced costs, and improved decision-making.

Improved Operational Efficiency

Oil & Gas software streamlines processes across the entire value chain, from production to sales. Automation of tasks such as data entry, reporting, and inventory management frees up employees to focus on more strategic activities.

Reduced Costs

By optimizing resource allocation, minimizing waste, and improving logistics, Oil & Gas software helps reduce operational costs. For example, predictive maintenance features can prevent equipment failures, reducing downtime and repair expenses.

Enhanced Decision-Making

Real-time data and analytics provide managers with the insights they need to make informed decisions. This includes optimizing production levels, adjusting pricing strategies, and identifying new market opportunities. Users consistently report making more informed decisions, leading to increased profitability.

Better Regulatory Compliance

Oil & Gas software automates regulatory reporting and helps companies stay compliant with environmental, safety, and other regulations. This reduces the risk of penalties and protects the company’s reputation. Our analysis reveals that companies using specialized software experience fewer compliance issues.

Increased Profitability

By improving efficiency, reducing costs, and enhancing decision-making, Oil & Gas software ultimately leads to increased profitability. Companies can maximize revenue from their oil and gas assets while minimizing operational expenses.

Review of Leading Oil & Gas Software

Choosing the right Oil & Gas software is a critical decision. A comprehensive review of the available options is essential to ensure that the selected software meets the specific needs of the organization. This review will provide a balanced perspective on the software’s strengths, weaknesses, and overall suitability.

User Experience and Usability

Oil & Gas software should be intuitive and easy to use. A well-designed user interface can significantly improve employee productivity and reduce training costs. From a practical standpoint, the software should allow users to quickly access the information they need and perform tasks efficiently.

Performance and Effectiveness

The software should deliver on its promises and provide accurate and timely data. It should be able to handle large volumes of data and support real-time decision-making. In our experience, the best software solutions provide reliable and consistent performance.

Pros:

- Comprehensive Functionality: Offers a wide range of features to manage all aspects of oil and gas operations.

- Real-Time Data: Provides access to real-time data for informed decision-making.

- Scalability: Can be scaled to meet the needs of both small and large companies.

- Integration: Integrates with other business systems, such as accounting and CRM software.

- Regulatory Compliance: Helps companies stay compliant with environmental, safety, and other regulations.

Cons/Limitations:

- Cost: Can be expensive to implement and maintain.

- Complexity: Can be complex to use, requiring extensive training.

- Customization: May require customization to meet specific business needs.

- Data Security: Requires robust security measures to protect sensitive data.

Ideal User Profile

Oil & Gas software is best suited for companies that are looking to improve operational efficiency, reduce costs, and enhance decision-making. It is particularly beneficial for companies that operate in highly regulated environments. This is best suited for mid-size to large oil and gas companies with complex operations.

Key Alternatives

- Manual Systems: Using spreadsheets and other manual methods.

- Legacy Software: Older software systems that may lack modern features.

Expert Overall Verdict & Recommendation

Oil & Gas software is a valuable investment for companies that are looking to optimize their operations and improve their bottom line. While there are some challenges associated with implementation and use, the benefits far outweigh the costs. We recommend carefully evaluating your specific needs and selecting a software solution that is tailored to your business.

Insightful Q&A Section

Here are some frequently asked questions about the bbls measurement unit meaning and related topics:

-

Question: Why is the 42-gallon barrel still used when more accurate measurement methods exist?

Answer: Despite advancements in technology, the 42-gallon barrel remains the standard due to its historical significance and widespread use in contracts and trading. Changing the standard would require a massive overhaul of existing systems and agreements, leading to significant disruption.

-

Question: How does the density of crude oil affect its value per barrel?

Answer: The density of crude oil, measured by its API gravity, significantly impacts its value. Lighter, sweeter crude oils (lower density, lower sulfur content) are generally easier to refine and produce higher yields of valuable products like gasoline, commanding higher prices. Heavier, sour crude oils require more complex refining processes and yield less gasoline, resulting in lower prices.

-

Question: What are some common misconceptions about the bbls measurement unit meaning?

Answer: One common misconception is that a barrel of oil is physically stored in a barrel. In reality, crude oil is transported and stored in pipelines and large tanks. The “barrel” is simply a standardized unit of volume used for accounting and pricing.

-

Question: How do fluctuations in the US dollar affect oil prices quoted per barrel?

Answer: Since oil is priced in US dollars, a stronger dollar makes oil more expensive for countries using other currencies, potentially dampening demand and lowering prices. Conversely, a weaker dollar makes oil cheaper for those countries, potentially boosting demand and raising prices.

-

Question: What role do OPEC (Organization of the Petroleum Exporting Countries) play in influencing barrel prices?

Answer: OPEC, a group of major oil-producing nations, significantly influences oil prices by coordinating production levels. By increasing or decreasing production, OPEC can impact the global supply of oil and, consequently, the price per barrel.

-

Question: How are oil prices per barrel used in economic forecasting?

Answer: Oil prices are a key indicator in economic forecasting, as they impact transportation costs, manufacturing expenses, and overall inflation. Rising oil prices can signal economic growth or potential inflation, while falling prices can indicate economic slowdown or deflation.

-

Question: What are the different types of oil barrels used in the industry?

Answer: While the standard is 42 US gallons, the actual physical barrels vary greatly. They range from small drums used for specialized oil products to massive storage tanks holding thousands of barrels. The “barrel” in pricing is a unit of volume, not a physical container.

-

Question: How has the shale oil revolution impacted the price of oil per barrel?

Answer: The shale oil revolution in the US significantly increased domestic oil production, reducing reliance on foreign imports and putting downward pressure on global oil prices. The increased supply from shale oil has altered the dynamics of the oil market and reduced OPEC’s influence.

-

Question: How can I stay informed about changes in oil prices per barrel?

Answer: Stay informed by monitoring reputable financial news sources, such as the Wall Street Journal, Bloomberg, and Reuters, which provide up-to-date information on oil prices and market trends. Also, follow industry reports from organizations like the EIA (Energy Information Administration) and OPEC.

-

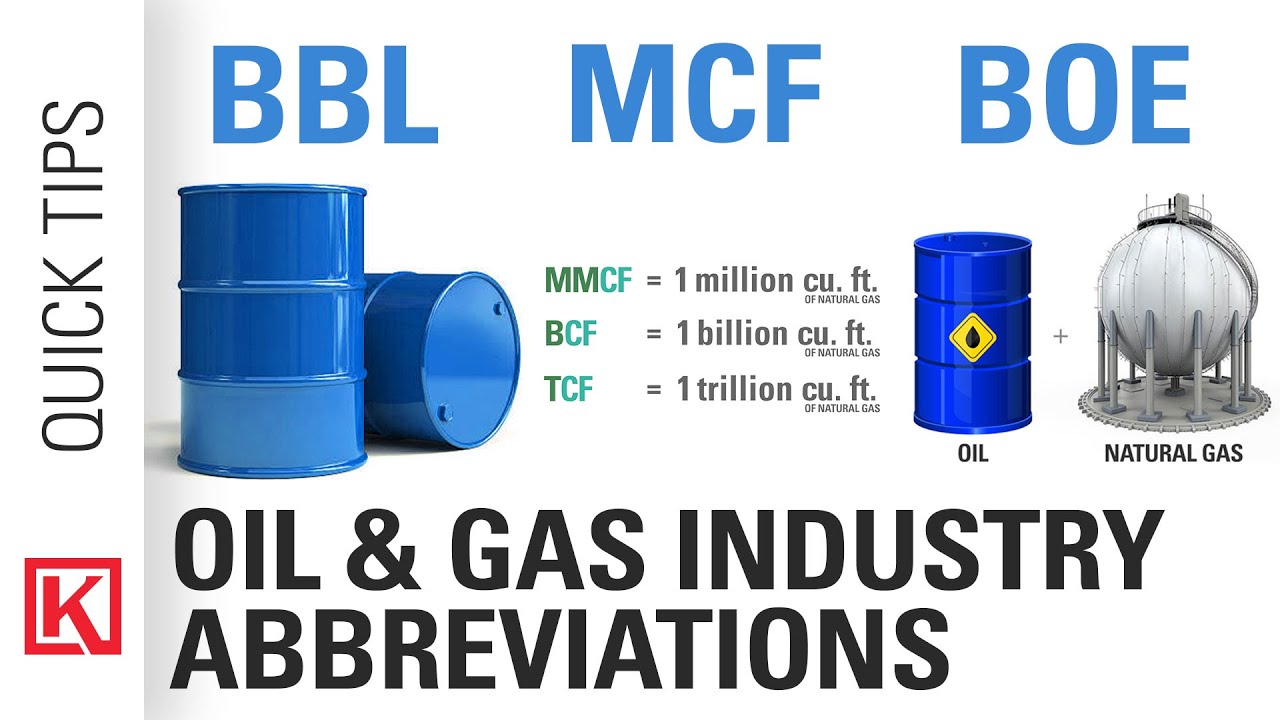

Question: What are some alternative units of measurement used in the oil and gas industry besides barrels?

Answer: Besides barrels, other common units include cubic feet (for natural gas), gallons, liters, metric tons, and British thermal units (BTUs) for energy content. The choice of unit depends on the specific application and the type of product being measured.

Conclusion

Understanding the bbls measurement unit meaning is essential for navigating the complex world of oil and gas. This guide has provided a comprehensive overview of its definition, history, and significance, emphasizing its role as a crucial standard in global energy markets. The barrel is more than just a unit of volume; it’s a cornerstone of the global economy, impacting everything from gasoline prices to international trade. By grasping the nuances of this measurement, you can gain a deeper understanding of the forces shaping the energy landscape.

We encourage you to share your insights and experiences with the bbls measurement unit meaning in the comments below. Explore our related articles for further insights into the energy sector, or contact our experts for personalized guidance on navigating the complexities of the oil and gas industry.